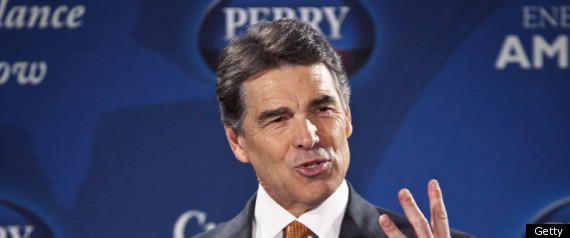

Republican presidential candidate Rick Perry says he wants a huge tax break for the rich, and he doesn't care what it means for income inequality.

Rick Perry announced on Tuesday that if elected president he would slash the corporate tax rate to 20 percent from 35 and give everyone the option of paying a flat income tax rate of 20 percent.

He also would try to encourage U.S. companies who have stored $1.4 trillion overseas to move their profits back to the United States by allowing them to pay 5.25 percent in taxes at first, according to Reuters.

The plan, if enacted, would dramatically reduce the tax burdens of the wealthiest people in the United States, saving millions of dollars for some, while raising taxes for poor and middle-class people who opt into the plan.

"I don't care about that," Perry said of the increased economic inequality that would result from the tax plan in an interview with The New York Times. "If that's what comes, I'll take that criticism."

Income inequality has been rising in the United States for the past three decades, as the top one-percent has claimed an increasing share of national income growth, according to the Center on Budget and Policy Priorities. Indeed, the top one-percent claimed 23.5 percent of all national income in 2007: its highest share of the national income since 1928.

Since the current U.S. tax system charges higher taxes from those with higher incomes, Perry's flat tax plan would raise the tax burden of the poor and middle class while slashing the taxes owed by the wealthiest Americans. Under the current system, the highest earners pay 35 percent of their income in taxes, and the lowest earners pay no income tax at all, according to Bloomberg News.

Perry's flat income tax proposal bears some similarities to Republican presidential candidate Herman Cain's 9-9-9 tax plan, in which the personal income tax rate, corporate income tax rate, and national sales tax rate all would be a flat nine percent.

On Tuesday, the Obama campaign immediately attacked Perry's tax plan, claiming that it "would shift a greater share of taxes away from large corporations and the wealthiest onto the backs of the middle class."

In the event that Perry's system were enacted, the wealthy would have an incentive to sign up for the flat tax system, saving thousands if not millions of dollars, while some low- and middle-income taxpayers would save more under the current progressive tax system. As an income tax calculator cited by The Daily Beast demonstrates, anyone earning more than about $74,000 (married but filing taxes separately) would receive a tax break under Perry's plan, and those earning less than $74,000 would see their taxes rise under Perry's optional tax plan.

On the revenue side, Perry's plan would simultaneously lead to substantial losses for the federal government as well as what James Horney, vice president at the Center on Budget and Policy Priorities, said would be "draconian cuts," in an interview with The New York Times.

Perry pledged in his Wall Street Journal op-ed published on Tuesday that he would cap federal spending at 18 percent of U.S. economic output.

As lenient as Perry's proposed 20 percent income tax would be for the wealthy, it would be higher than the nonexistent income tax in Texas, which Perry leads as governor.

Origin

Source: Huff

Rick Perry announced on Tuesday that if elected president he would slash the corporate tax rate to 20 percent from 35 and give everyone the option of paying a flat income tax rate of 20 percent.

He also would try to encourage U.S. companies who have stored $1.4 trillion overseas to move their profits back to the United States by allowing them to pay 5.25 percent in taxes at first, according to Reuters.

The plan, if enacted, would dramatically reduce the tax burdens of the wealthiest people in the United States, saving millions of dollars for some, while raising taxes for poor and middle-class people who opt into the plan.

"I don't care about that," Perry said of the increased economic inequality that would result from the tax plan in an interview with The New York Times. "If that's what comes, I'll take that criticism."

Income inequality has been rising in the United States for the past three decades, as the top one-percent has claimed an increasing share of national income growth, according to the Center on Budget and Policy Priorities. Indeed, the top one-percent claimed 23.5 percent of all national income in 2007: its highest share of the national income since 1928.

Since the current U.S. tax system charges higher taxes from those with higher incomes, Perry's flat tax plan would raise the tax burden of the poor and middle class while slashing the taxes owed by the wealthiest Americans. Under the current system, the highest earners pay 35 percent of their income in taxes, and the lowest earners pay no income tax at all, according to Bloomberg News.

Perry's flat income tax proposal bears some similarities to Republican presidential candidate Herman Cain's 9-9-9 tax plan, in which the personal income tax rate, corporate income tax rate, and national sales tax rate all would be a flat nine percent.

On Tuesday, the Obama campaign immediately attacked Perry's tax plan, claiming that it "would shift a greater share of taxes away from large corporations and the wealthiest onto the backs of the middle class."

In the event that Perry's system were enacted, the wealthy would have an incentive to sign up for the flat tax system, saving thousands if not millions of dollars, while some low- and middle-income taxpayers would save more under the current progressive tax system. As an income tax calculator cited by The Daily Beast demonstrates, anyone earning more than about $74,000 (married but filing taxes separately) would receive a tax break under Perry's plan, and those earning less than $74,000 would see their taxes rise under Perry's optional tax plan.

On the revenue side, Perry's plan would simultaneously lead to substantial losses for the federal government as well as what James Horney, vice president at the Center on Budget and Policy Priorities, said would be "draconian cuts," in an interview with The New York Times.

Perry pledged in his Wall Street Journal op-ed published on Tuesday that he would cap federal spending at 18 percent of U.S. economic output.

As lenient as Perry's proposed 20 percent income tax would be for the wealthy, it would be higher than the nonexistent income tax in Texas, which Perry leads as governor.

Origin

Source: Huff

No comments:

Post a Comment