Hey, no fair fighting back!!

That's what I hear when conservatives go on about "class warfare" in

response the President's call for balance in deficit reduction. It's

particularly grating to hear Rep Paul Ryan use the CW talking point,

when the loins' share of his deficit savings come from cuts to

low-income programs and Medicare, with no offsetting revenue.

Lots of posts in recent days have explored the tax side of this

equation, essentially emphasizing the Buffett point that many of those

who have done the best are paying a smaller share of the income in

federal taxes than the middle class. That's an important point that

links directly to President Obama's call for shared sacrifice and

balanced deficit reduction. Sorry, Rep. Ryan -- it can't all come out of

the spending side.

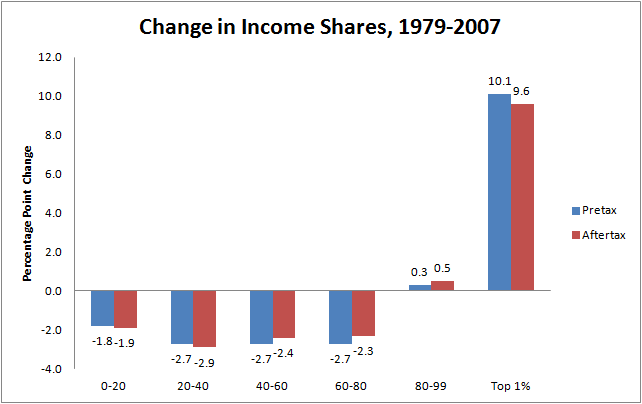

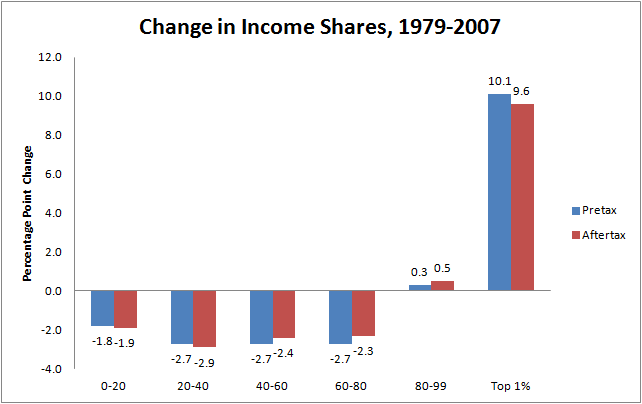

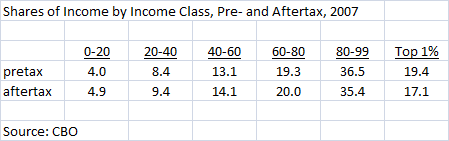

But, as the figure below reveals, the increase in income inequality

-- one reliable metric of how different income classes have fared -- is

very much a pretax phenomenon. The figure shows the changes in income

shares from a comprehensive income

data set

of the Congressional Budget Office, 1979-2007, pretax and aftertax

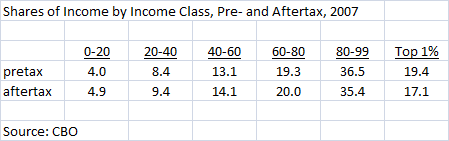

(federal taxes only -- I've added a table below with the levels for the

most recent data year so you can see the underlying shares).

Source: CBO

Source: CBO

The fact that the growth in inequality is largely a function of the

pretax income distribution doesn't mean we should make it worse with

regressive, supply-side tax cuts -- (economist Alan Blinder calls this

move "unnecessary roughness" -- amplifying pretax inequality with

regressive tax cuts). To the contrary, we need balanced tax measures to

generate the revenues to support programs that can help push back on

this

trend -- initiatives like Head Start, child nutrition, educational support.

But it also doesn't mean we can meaningfully correct the problem with

tax policy alone. We have be mindful of all the policies that effect

the pretax distribution--the distribution of labor and capital earnings

before any taxes and transfers kick in...that's where the real

inequality action is.

Now, most economists argue that much of the increase in inequality is

due to factors like globalization and technological change -- factors

that are less a matter of policy than of economic evolution. But of

course their impact can be amplified or dampened by policy. For example,

unfair trade practices like China currency management make give

low-wage competitors an even stronger price advantage. (Trade agreements

are less of a big deal as I see it--the advocates overdo how much

they'll help and visa-versa re the opponents -- though the advocates are

worse...).

Lack of a strong, long-term public-private strategy in terms of

boosting our manufacturing sector, as is standard practice in advanced

(Germany) and emerging (China) countries also hurts our manufacturers

compete internationally. So policy does matter -- considerably -- in

this space.

Technological change is also thought to be a significant factor

behind the changes in the graph, though the evidence here is more

ambiguous. (One

strain of work, for example, argues that technology has increased labor demand for both high skill

and

low skill work, while leaving out the middle.) But to the extent that

technology increases employers' skill demands such that a college

education is increasingly necessary to compete, programs that help

disadvantaged kids get that opportunity play a role here too. And cuts

to those programs hurt.

And then there's a bunch of stuff that directly raises or lowers the

bargaining clout of middle and working class families--policy changes or

missed policy opportunities that have hurt or failed to help them.

- The long-term erosion of the minimum wage

- The absence of legislative protection to balance the organizing playing field for those who want to collectively bargain

- The inattention to labor standards such as wage and hour rules,

overtime regulations, workplace safety, worker classification (this is

where regular employees get misclassified as independent contractors and

lose basic labor protections -- and guess what? Progressive reform of

this problem is in the President's new budget plan -- very cool...)

- The attack on public sector employment

- The lack of universal health care

- The absence of comprehensive immigration reform

One more biggie: full employment. It's very much a policy variable

and one, in fact, that used to be the law for the Federal Reserve --

so-called Humphrey Hawkins Act mandated full employment as a policy goal

of the Fed. As I stress

here,

the fact that our job market has run with so much slack over the very

period when inequality grew is no coincidence (and visa-versa: when

inequality was flat or falling, we were more likely to be at full

employment).

And of course, in recession, like now, by dithering on stimulus,

we're disproportionately hurting the wage, incomes, and living standards

of the folks who've been losing income share over the years shown in

the figure above.

In other words, there are a lot of policy measures that have

considerable impact on how the benefits of growth are distributed --

before taxes even show up on the scene. When representatives of the

wealthy squeal about "class warfare," they're not just talking about

shielding their treasure from the tax system. They're also protecting

and endorsing a policy agenda that's helped tilt growth their way for a

long time.

Origin

Source: Huffington

Origin

Source: Huffington