OTTAWA - U.S. employment numbers disappointed for the second consecutive month on Friday. This upcoming Friday, it's likely Canadians' turn to be disappointed.

OTTAWA - U.S. employment numbers disappointed for the second consecutive month on Friday. This upcoming Friday, it's likely Canadians' turn to be disappointed.After a strong start to the year, the economies in Canada and systemically important nations appear to have entered a synchronized late winter-early spring swoon that few saw coming.

Less than a month after the Bank of Canada upgraded growth prospects for both Canada and the U.S. and downgraded risks in Europe, the roof hasn't exactly caved in, but the puddles are forming on the kitchen floor.

The European recession has gone from mild to scary, with some major nations such as Spain posting depression-era 25-per-cent jobless rates. Emerging markets have slowed. The United States posted its second consecutive below consensus employment report of a mere 115,000 jobs added in April. Even in Canada, gross domestic product shockingly fell in February by 0.2 per cent.

"Clearly we have seen a deceleration of economic activity more or less around the world," said Eric Laschelles, chief economist with RBC Global Asset Management.

"The message of the last few years is don't over do it. On occasion the market and forecasters have jumped on the trend too many times. The reality is we're in a sluggish growth environment, we've been there for four years and we'll probably be there for several more."

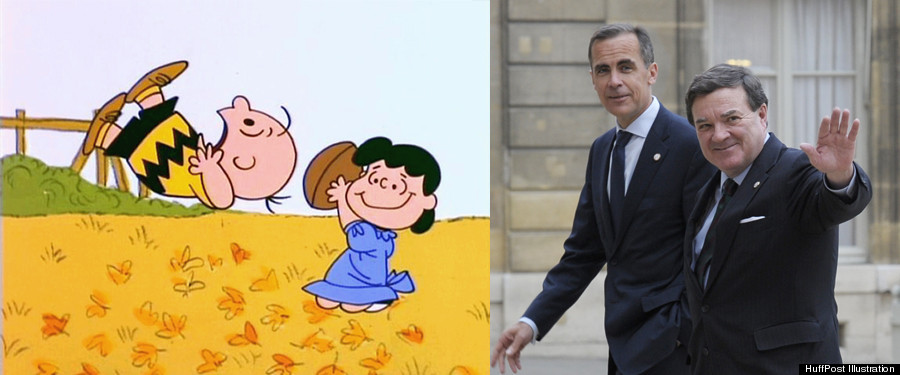

Economists refer to the phenomenon as a "head fake" — the real world equivalent of Lucy snatching away the football from Charlie Brown's approaching foot — and it appears to have fooled the experts for the third year in a row.

Last year, a second-quarter contraction was precipitated by supply-chain disruptions from Japan's natural disaster and an oil shock caused by political uncertainty in the Middle East.

This year, analysts are blaming an unusually mild winter that pushed some activity forward, persistently high oil prices and in Canada, the drag of governments flipping the switch from fiscal stimulus to restraint.

"It seems like it's deja vu all over again where the markets and analysts overestimated the strength in the economy because of a nice start to the year," agreed Bank of Montreal deputy chief economist Doug Porter, who has stuck to his long-held view that the economy will barely eke out a two per cent advance this year.

For Canada, Porter said it's already beyond the realm of reasonable probability the Bank of Canada's 2.5 per cent annualized growth estimate for the first and second quarters can be met.

Capital Economics on Friday officially took their 2.5 target for the first three months off the table and inserted an anemic 1.5 per cent in its place.

That's an important distinction because at 2.5 per cent growth, the Bank of Canada had calculated the capacity gap in the economy would close by the first half of 2013, setting up a scenario where governor Mark Carney would feel comfortable in hiking interest rates later this year.

At 1.5 per cent growth, the output gap is actually widening, suggesting no hike until at least 2013.

As for employment prospects, economies don't create jobs at faster rates than output for very long, so many analysts predict Friday's employment report will see a big payback from March's eye-popping 82,000 reading. Capital Economics' David Madani says 10,000 is more like it.

The question is: how long does the stall last?

The current run of disappointing results, particularly in North America, may be a case of what CIBC economist Avery Shenfeld calls the mixed news that comes from a mediocre economy.

Under that assumption, the current softness will likely soon give way to a run of stronger data, the scenario most analysts envision.

Finance Minister Jim Flaherty was of this view in comments to reporters following the release of the U.S. jobs data.

'We anticipate a lumpy recovery this year. But when we get to the end of the year and look back we'll see the moderate growth that was anticipated will have occurred," he said.

"The danger is we would have another type of banking crisis (out of Europe) ... which would inevitably affect Canada because we are part of a trading world, a global economy," he added.

Barring that now familiar — and still very real risk — RBC's Laschelles says another concern is the so-called "fiscal cliff" looming at the end of the year in the U.S.

Much like last summer's debt ceiling crisis, partisan political intransigence could push the U.S. to the brink of recession if Congress does not agree to extend temporary tax cuts and push back spending reductions scheduled to start Jan. 1.

Laschelles said some estimates suggest the fiscal cliff is big enough to chop three or four percentage points from the U.S. economy. Federal Reserve chairman Ben Bernanke has warned it's so large, he doesn't have the tools to compensate.

The betting is that even the U.S. Congress is not suicidal, but the risk is not zero, Laschelles said, which is also his verdict on the odds against the recent run of bad data signalling the beginning of a serious downturn that lasts beyond a few months.

Original Article

Source: Huff

Author: Julian Beltrame

No comments:

Post a Comment