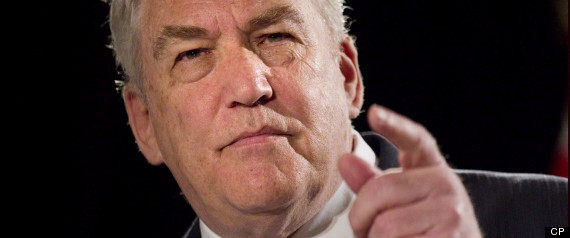

As if Conrad Black wasn’t involved in enough fights as it is, the former media mogul is now facing a battle with the Canada Revenue Agency over $3 million the tax collector says he owes the federal government.

The CRA is asking the erstwhile newspaper baron to pay taxes as a Canadian resident for 2002, though Black's lawyers say the agency had previously accepted that, for tax purposes, Black was a resident of the U.K. that year.

According to the Toronto Star, among the things the CRA wants to collect on is $1.3 million in benefits from the use of a private jet owned by Hollinger International, a company that Black controlled at the time, as well as $90,000 in benefits from security at his Toronto home.

Black had homes in both the U.K. and Canada in 2002, as well as a vacation home in Florida. According to documents obtained by QMI Agency, the CRA began sniffing around Black’s Canadian tax returns in 2009, when he was in the midst of serving a six-year prison sentence in the U.S. for fraud and obstruction of justice, charges which Black continues to dispute.

Black and his lawyers have suggested the CRA’s pursuit of back taxes is unusual, and may be singling out the disgraced media mogul.

While Black had been treated as a non-resident by the tax agency since the 1990s, “the CRA changed its tune in the 2002 taxation year,” lawyer David Nathanson said.

In an email to HuffPost, Black described the CRA’s claim as “nonsense.”

“Doesn’t it strike you as odd, after 11 years?” he asked.

Black’s lawyers have said he has already paid taxes on $808,000 he earned inside Canada in 2002.

Canadian tax law states that someone who is a resident must pay taxes on all their income from around the world. If Black is deemed a resident of Canada for 2002, he will have to pay taxes not just on what he earned in Canada, but everywhere.

Whether or not someone is a resident of Canada under tax rules is a complicated issue, and the CRA makes a determination by looking at factors such as someone’s ties to the country, and the amount of time they spent inside Canada during a given year.

At a court hearing on May 15, Black’s lawyers will ask the Tax Court to declare him a U.K. resident for 2002.

If the Tax Court of Canada agrees with the CRA, Black will owe the tax money plus interest, which could double the figure owed to $6 million, QMI Agency reported.

If the CRA succeeds, it could pursue Black for back taxes for 2003 and 2004 as well, QMI Agency reported.

Original Article

Source: huffingtonpost.ca

Author: Daniel Tencer

The CRA is asking the erstwhile newspaper baron to pay taxes as a Canadian resident for 2002, though Black's lawyers say the agency had previously accepted that, for tax purposes, Black was a resident of the U.K. that year.

According to the Toronto Star, among the things the CRA wants to collect on is $1.3 million in benefits from the use of a private jet owned by Hollinger International, a company that Black controlled at the time, as well as $90,000 in benefits from security at his Toronto home.

Black had homes in both the U.K. and Canada in 2002, as well as a vacation home in Florida. According to documents obtained by QMI Agency, the CRA began sniffing around Black’s Canadian tax returns in 2009, when he was in the midst of serving a six-year prison sentence in the U.S. for fraud and obstruction of justice, charges which Black continues to dispute.

Black and his lawyers have suggested the CRA’s pursuit of back taxes is unusual, and may be singling out the disgraced media mogul.

While Black had been treated as a non-resident by the tax agency since the 1990s, “the CRA changed its tune in the 2002 taxation year,” lawyer David Nathanson said.

In an email to HuffPost, Black described the CRA’s claim as “nonsense.”

“Doesn’t it strike you as odd, after 11 years?” he asked.

Black’s lawyers have said he has already paid taxes on $808,000 he earned inside Canada in 2002.

Canadian tax law states that someone who is a resident must pay taxes on all their income from around the world. If Black is deemed a resident of Canada for 2002, he will have to pay taxes not just on what he earned in Canada, but everywhere.

Whether or not someone is a resident of Canada under tax rules is a complicated issue, and the CRA makes a determination by looking at factors such as someone’s ties to the country, and the amount of time they spent inside Canada during a given year.

At a court hearing on May 15, Black’s lawyers will ask the Tax Court to declare him a U.K. resident for 2002.

If the Tax Court of Canada agrees with the CRA, Black will owe the tax money plus interest, which could double the figure owed to $6 million, QMI Agency reported.

If the CRA succeeds, it could pursue Black for back taxes for 2003 and 2004 as well, QMI Agency reported.

Original Article

Source: huffingtonpost.ca

Author: Daniel Tencer

No comments:

Post a Comment