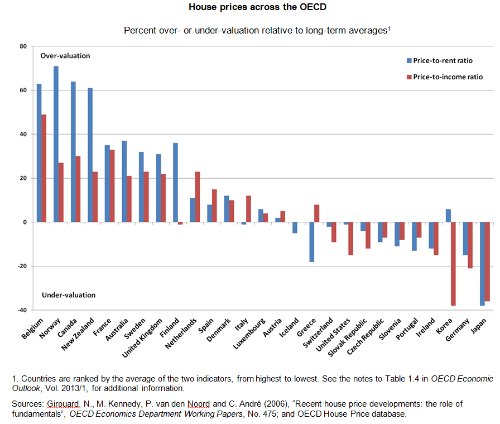

Canada has the third-most overvalued housing market in the developed world, the OECD says in a new report, and the latest market data released this week suggests that this is not changing.

The OECD’s latest global economic outlook estimates that Canada’s housing market is overvalued by 64 per cent when compared to rental rates, and by 30 per cent when compared to incomes.

That places Canada in a small group of countries “where houses appear overvalued but prices are still rising,” the OECD said.

Belgium has the world's most overvalued housing market, followed by Norway in second place. The U.S. was listed as having the eighth-most undervalued market.

“Economies in this category are most vulnerable to the risk of a price correction – especially if borrowing costs were to rise or income growth were to slow.”

That doesn’t appear to be happening, at least for the moment. Income growth in Canada picked up last year after a lacklustre 2011, and most analysts don’t expect interest rates to rise until 2014 at the earliest.

But when they do (and that is a when, not an if), it could cause serious problems in the housing market.

According to a 2011 survey for the Canadian Association of Accredited Mortgage Professionals, even a one-per-cent rate hike could make payments unaffordable for more than one in 10 mortgage holders. A two-per-cent hike (which would leave interest rates still well below historic norms) would mean one in five Canadians could no longer afford their mortgages.

That’s hardly the sign of a healthy real estate market. And Finance Minister Jim Flaherty’s openly-voiced hope that Canada will see some house price declines doesn’t seem to be materializing, at least not yet, and at least not outside Vancouver.

Condo Market’s ‘Last Hurrah’

The latest data from the Toronto Real Estate Board shows house prices for existing homes in Canada’s largest city rose in May from a year ago, even as total sales continued to decline — down 3.4 per cent, year over year, continuing a year-long slide.

The average selling price, however, was $542,174, up by 5.4 per cent from a year ago.

Even Vancouver, whose housing market even the optimists admit is a bursting bubble, saw sales rise one per cent year over year, though prices in the city are down 4.3 per cent from last year.

Meanwhile, building permits across the country soared in April, up 10.5 per cent from the month before, including a whopping 50-per-cent increase in the softening condo market.

But CIBC economist Emanuella Enenajor must have been looking at all the reports of over-building in the condo market, because instead of declaring a bounce-back, she suggested condo bust is just getting started.

“Construction [in condos] could be set for one last hurrah,” she declared.

Overbuilding Everywhere

If economists aren’t buying any sort of bounce-back in the market, particularly in condos, that can be largely attributed to perceptions that Canada has experienced an over-building of homes.

While many observers have long argued that Toronto’s condo market is particularly overbuilt, a TD report this week declared that “overbuilding, to various degrees, has occurred across all markets.”

The report said the recent slowdown in sales and construction “has moved back in line with household formation in most major markets” — but that was before this week’s report of a large jump in construction starts.

Original Article

Source: huffingtonpost.ca

Author: Daniel Tencer

The OECD’s latest global economic outlook estimates that Canada’s housing market is overvalued by 64 per cent when compared to rental rates, and by 30 per cent when compared to incomes.

That places Canada in a small group of countries “where houses appear overvalued but prices are still rising,” the OECD said.

Belgium has the world's most overvalued housing market, followed by Norway in second place. The U.S. was listed as having the eighth-most undervalued market.

“Economies in this category are most vulnerable to the risk of a price correction – especially if borrowing costs were to rise or income growth were to slow.”

That doesn’t appear to be happening, at least for the moment. Income growth in Canada picked up last year after a lacklustre 2011, and most analysts don’t expect interest rates to rise until 2014 at the earliest.

But when they do (and that is a when, not an if), it could cause serious problems in the housing market.

According to a 2011 survey for the Canadian Association of Accredited Mortgage Professionals, even a one-per-cent rate hike could make payments unaffordable for more than one in 10 mortgage holders. A two-per-cent hike (which would leave interest rates still well below historic norms) would mean one in five Canadians could no longer afford their mortgages.

That’s hardly the sign of a healthy real estate market. And Finance Minister Jim Flaherty’s openly-voiced hope that Canada will see some house price declines doesn’t seem to be materializing, at least not yet, and at least not outside Vancouver.

Condo Market’s ‘Last Hurrah’

The latest data from the Toronto Real Estate Board shows house prices for existing homes in Canada’s largest city rose in May from a year ago, even as total sales continued to decline — down 3.4 per cent, year over year, continuing a year-long slide.

The average selling price, however, was $542,174, up by 5.4 per cent from a year ago.

Even Vancouver, whose housing market even the optimists admit is a bursting bubble, saw sales rise one per cent year over year, though prices in the city are down 4.3 per cent from last year.

Meanwhile, building permits across the country soared in April, up 10.5 per cent from the month before, including a whopping 50-per-cent increase in the softening condo market.

But CIBC economist Emanuella Enenajor must have been looking at all the reports of over-building in the condo market, because instead of declaring a bounce-back, she suggested condo bust is just getting started.

“Construction [in condos] could be set for one last hurrah,” she declared.

Overbuilding Everywhere

If economists aren’t buying any sort of bounce-back in the market, particularly in condos, that can be largely attributed to perceptions that Canada has experienced an over-building of homes.

While many observers have long argued that Toronto’s condo market is particularly overbuilt, a TD report this week declared that “overbuilding, to various degrees, has occurred across all markets.”

The report said the recent slowdown in sales and construction “has moved back in line with household formation in most major markets” — but that was before this week’s report of a large jump in construction starts.

Original Article

Source: huffingtonpost.ca

Author: Daniel Tencer

No comments:

Post a Comment