The real cost of student loan debt is far greater than you may think, according to a new analysis.

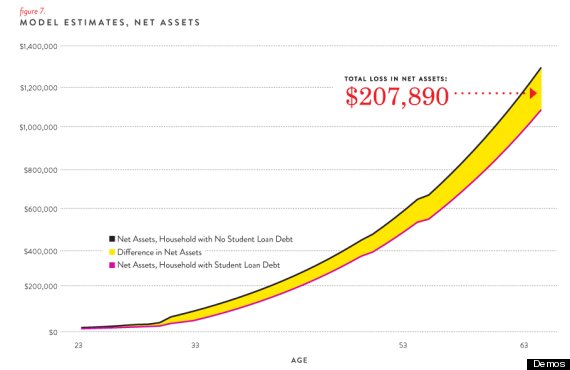

A household with $53,000 in outstanding student debt -- which is the average college loan balance for a family headed by two people with 4-year degrees -- will be about $208,000 poorer over a lifetime than a similar household with no debt, a study released Thursday by public policy research organization Demos found.

To arrive at this number, researchers created a model that compared two nearly-identical dual-headed, college-educated households, one of which had student debt and the other did not. The model assumed that members of the two households earned the same salaries, had the same money available for retirement and purchased homes at the same time, among other factors.

Though Demos’ findings are based on a theoretical model and focus on college-educated households with two earners, the research still paints a grim picture of the burden student debt places on borrowers. The researchers noted that the lifetime wealth loss could be more than $208,000 for borrowers with larger-than-average education debt, students from low-income families and those that attended for-profit colleges.

Extrapolating the data, Demos found that the nation’s $1 trillion in outstanding student debt would amount to an aggregate wealth loss of about $4 trillion over the lifetime of the borrowers. The calculation assumes that the average amount of debt held by bachelor’s degree recipients represents the median amount of college debt held by borrowers overall.

Robert Hiltonsmith, the policy analyst at Demos who authored the report, told The Huffington Post in an e-mail that his $4 trillion estimate is “actually likely on the low side,” because the $1 trillion in outstanding debt includes borrowers who didn’t finish college and therefore don’t get the income boost that comes from earning a degree.

The Demos analysis adds to the growing body of evidence that student debt is weighing on borrowers' -- and the nation's -- economic future. Young workers with college loans are much less likely to buy houses, cars and other major purchases than their unburdened counterparts, according to an April study from the Federal Reserve Bank of New York.

Still, despite the burden of student loans, attending college may be worth the investment. Students who complete just “some college” earn $100,000 more on average over a lifetime than their peers with a high school diploma, a June analysis from the Hamilton Project found.

Original Article

Source: huffingtonpost.com

Author: The Huffington Post

A household with $53,000 in outstanding student debt -- which is the average college loan balance for a family headed by two people with 4-year degrees -- will be about $208,000 poorer over a lifetime than a similar household with no debt, a study released Thursday by public policy research organization Demos found.

To arrive at this number, researchers created a model that compared two nearly-identical dual-headed, college-educated households, one of which had student debt and the other did not. The model assumed that members of the two households earned the same salaries, had the same money available for retirement and purchased homes at the same time, among other factors.

Though Demos’ findings are based on a theoretical model and focus on college-educated households with two earners, the research still paints a grim picture of the burden student debt places on borrowers. The researchers noted that the lifetime wealth loss could be more than $208,000 for borrowers with larger-than-average education debt, students from low-income families and those that attended for-profit colleges.

Extrapolating the data, Demos found that the nation’s $1 trillion in outstanding student debt would amount to an aggregate wealth loss of about $4 trillion over the lifetime of the borrowers. The calculation assumes that the average amount of debt held by bachelor’s degree recipients represents the median amount of college debt held by borrowers overall.

Robert Hiltonsmith, the policy analyst at Demos who authored the report, told The Huffington Post in an e-mail that his $4 trillion estimate is “actually likely on the low side,” because the $1 trillion in outstanding debt includes borrowers who didn’t finish college and therefore don’t get the income boost that comes from earning a degree.

The Demos analysis adds to the growing body of evidence that student debt is weighing on borrowers' -- and the nation's -- economic future. Young workers with college loans are much less likely to buy houses, cars and other major purchases than their unburdened counterparts, according to an April study from the Federal Reserve Bank of New York.

Still, despite the burden of student loans, attending college may be worth the investment. Students who complete just “some college” earn $100,000 more on average over a lifetime than their peers with a high school diploma, a June analysis from the Hamilton Project found.

Original Article

Source: huffingtonpost.com

Author: The Huffington Post

No comments:

Post a Comment