When most people think about farm subsidies, chances are they do not

immediately think "massive taxpayer money boondoggle that should be cut

from the federal budget immediately." They've probably heard about how

hard it is out there for small family farmers, doing honest work in the

world, keeping everyone fed and maintaining our institutional repository

of agricultural practices. Surely, these subsidies are helping to keep

an important way of life alive for the True Sons of Soil and Toil ...

like, say, multi-billionaire Microsoft co-founder Paul Allen.

Wait. What? He's a farmer?

Ha ha, yes. As it turns out, your taxpayer dollars "subsidize" the "farming" that's being done by a host of mega-rich superstars from the Forbes 400 list, none of whom you'd immediately associate with the sort of hardscrabble agri-artisan who's in need of a leg up from the federal government. But their numbers are legion. According to the Environmental Working Group, "at least 50 billionaires or farm businesses in which they had a financial interest benefited from $11.3 million in traditional farm subsidies between 1995 and 2012." And the farm bill currently being considered contains changes that will likely increase the subsidies these billionaires take away.

It would also affect several members of Congress. As we reported back in June, there's a $237,921 kitty of farm subsidies currently going to fifteen lawmakers or their spouses. That includes people like Reps. Stephen Fincher (R-Tenn.) and Doug LaMalfa (R-Calif.), who are apparently budding ironists in the world of government handouts:

It's probably pretty embarrassing for those guys to be subjected to stories that point out what staggering hypocritical bastards they are, so Congress is trying to change the law to make things a lot less transparent. As HuffPost reported:

Both chambers of Congress have passed versions of the farm bill, and right now a conference committee is working to resolve differences between them. So you should click over to the EWG's analysis and take one last look at the billionaire beneficiaries of taxpayer farm handouts before our ability to track them transparently vanishes in the fog of this new law.

“Farm programs that benefit billionaires are indefensible and irresponsible," writes Alex Rindler, the EWG policy associate who authored the analysis. "The information shows that our broken policies propped up the richest few at the expense of taxpayers and struggling families – that’s a backwards vision that no one should be proud of.”

Here are some highlights:

Paul Allen, co-founder of Microsoft

Net worth: $15.8 billion

His Kona Residence Trust received $14,429 in barley subsidies from 1996 to 2006.

Philip Anschutz, owner of Anschutz Entertainment Group and co-founder of Major League Soccer

Net worth: $10 billion

His Clm Company received $553,323 in cotton, wheat, sorghum, corn, oat, barley and other farm subsidies from 1995-2003. His Equus Farms received $53,291 in livestock subsidies in 2002.

S. Truett Cathy, founder of Chick-fil-A

Net worth: $6 billion

His Rock Ranch LLC received $4,536 in livestock subsidies in 2003.

Richard DeVos, co-founder of Amway

Net worth: $6.8 billion

His Ada Holdings LLC received $37,986 in corn, wheat and soybean subsidies from 2001 to 2006.

Charles Ergen, co-founder of DISH Network

Net worth: $12.5 billion

His Telluray Ranch received $117,826 in crop and livestock disaster payments from 2002 to 2008.

Jim Kennedy, chairman of Cox Enterprises

Net worth: $6.7 billion

Net worth: $6.7 billion

Kennedy received $37,162 in rice, corn, sorghum, wheat, soybean, sunflower and other farm subsidies from 1996 to 2004. His York Woods At Yonkapin Cutoff LLC, received $19,545 in rice, sorghum and soybean subsidies from 2002 to 2003.

Leonard Lauder, former CEO of the Estee Lauder Companies Inc.

Net worth: $7.6 billion

His Horizon Organic Dairy Idaho Farm received $360,102 in wheat, diary, barley, corn and other farm subsidies from 1997 to 2004. His Horizon Organic Dairy Maryland Farm received $202,088 in dairy, corn, soybean, wheat and other farm subsidies from 1998 to 2005.

Penny Pritzker, U.S. Secretary of Commerce

Net worth: $2.2 billion

Her Chicago Mill & Lumber Co. received $1,604,288 in cotton, soybean, corn, sorghum, wheat, rice, oat and other farm subsidies from 1996 to 2006.

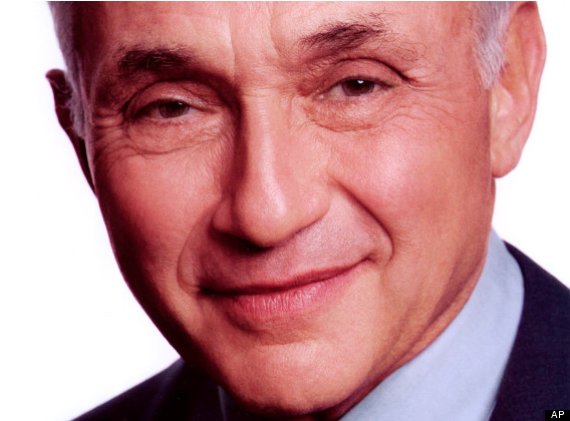

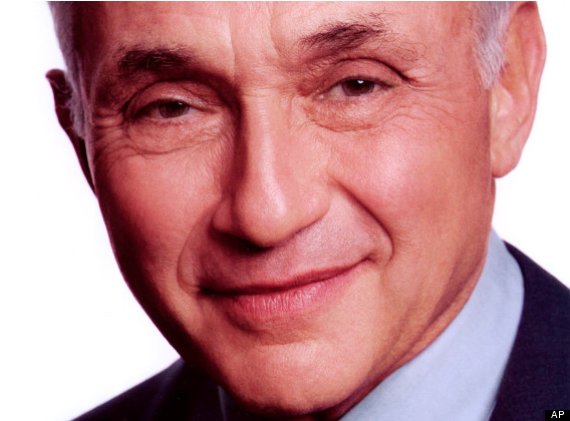

Charles Schwab, founder of brokerage firm Charles Schwab Corporation

Net worth: $5.1 billion

Schwab received $525,593 in rice and other farm subsidies from 1995 to 2003.

Alice and Jim Walton, Wal-Mart heirs

Net worth: $33.5 billion and $33.8 billion, respectively.

Their Robson Ranch Inc. received $261,292 in crop disaster payments, wheat, soybean, corn and other farm subsidies from 1995 to 2008.

Leslie Wexner, CEO of L Brands Inc., which owns Victoria's Secret

Net worth: $5.7 billion

His LAW Plantation Co. LLC received $209,717 in wheat, corn, sorghum and oat subsidies from 1997 to 2003.

Original Article

Source: huffingtonpost.com

Author: Jason Linkins

Wait. What? He's a farmer?

Ha ha, yes. As it turns out, your taxpayer dollars "subsidize" the "farming" that's being done by a host of mega-rich superstars from the Forbes 400 list, none of whom you'd immediately associate with the sort of hardscrabble agri-artisan who's in need of a leg up from the federal government. But their numbers are legion. According to the Environmental Working Group, "at least 50 billionaires or farm businesses in which they had a financial interest benefited from $11.3 million in traditional farm subsidies between 1995 and 2012." And the farm bill currently being considered contains changes that will likely increase the subsidies these billionaires take away.

It would also affect several members of Congress. As we reported back in June, there's a $237,921 kitty of farm subsidies currently going to fifteen lawmakers or their spouses. That includes people like Reps. Stephen Fincher (R-Tenn.) and Doug LaMalfa (R-Calif.), who are apparently budding ironists in the world of government handouts:

Reps. Stephen Fincher (R-Tenn.) and Doug LaMalfa (R-Calif.) both cited the Bible last week to argue that while individual Christians have a responsibility to feed the poor, the federal government does not. "We're all here on this committee making decisions about other people's money," Fincher said.

LaMalfa said that while it's nice for politicians to boast about how they've helped their constituents, "That's all someone else's money."

Yet both men's farms have received millions in federal assistance, according to the Environmental Working Group, a nonprofit that advocates for more conservation and fewer subsidies. LaMalfa's family rice farm has received more than $5 million in commodity subsidies since 1995, according to the group's analysis of data from the U.S. Agriculture Department, while Fincher's farm has received more than $3 million since then.

Last year alone, Fincher's farm received $70,574 and LaMalfa's got $188,570.

It's probably pretty embarrassing for those guys to be subjected to stories that point out what staggering hypocritical bastards they are, so Congress is trying to change the law to make things a lot less transparent. As HuffPost reported:

The House and Senate farm bill drafts eliminate most direct payments and instead boost subsidies for farmers to buy crop insurance policies that protect against losses from weather or price changes. Since the government divulges the names of people who get the payments but not the insurance subsidies, the Environmental Working Group's Scott Faber says the bills as they stand now would reduce government transparency. "Although much ballyhooed, the end of direct payments really heralds the replacement of an inequitable and transparent safety net with a more inequitable and less transparent safety net," Faber said. "Crop insurance subsidies have no limits on who can receive them and the amount they can receive."

Both chambers of Congress have passed versions of the farm bill, and right now a conference committee is working to resolve differences between them. So you should click over to the EWG's analysis and take one last look at the billionaire beneficiaries of taxpayer farm handouts before our ability to track them transparently vanishes in the fog of this new law.

“Farm programs that benefit billionaires are indefensible and irresponsible," writes Alex Rindler, the EWG policy associate who authored the analysis. "The information shows that our broken policies propped up the richest few at the expense of taxpayers and struggling families – that’s a backwards vision that no one should be proud of.”

Here are some highlights:

Paul Allen, co-founder of Microsoft

Net worth: $15.8 billion

His Kona Residence Trust received $14,429 in barley subsidies from 1996 to 2006.

Philip Anschutz, owner of Anschutz Entertainment Group and co-founder of Major League Soccer

Net worth: $10 billion

His Clm Company received $553,323 in cotton, wheat, sorghum, corn, oat, barley and other farm subsidies from 1995-2003. His Equus Farms received $53,291 in livestock subsidies in 2002.

S. Truett Cathy, founder of Chick-fil-A

Net worth: $6 billion

His Rock Ranch LLC received $4,536 in livestock subsidies in 2003.

Richard DeVos, co-founder of Amway

Net worth: $6.8 billion

His Ada Holdings LLC received $37,986 in corn, wheat and soybean subsidies from 2001 to 2006.

Charles Ergen, co-founder of DISH Network

Net worth: $12.5 billion

His Telluray Ranch received $117,826 in crop and livestock disaster payments from 2002 to 2008.

Jim Kennedy, chairman of Cox Enterprises

Net worth: $6.7 billion

Net worth: $6.7 billionKennedy received $37,162 in rice, corn, sorghum, wheat, soybean, sunflower and other farm subsidies from 1996 to 2004. His York Woods At Yonkapin Cutoff LLC, received $19,545 in rice, sorghum and soybean subsidies from 2002 to 2003.

Leonard Lauder, former CEO of the Estee Lauder Companies Inc.

Net worth: $7.6 billion

His Horizon Organic Dairy Idaho Farm received $360,102 in wheat, diary, barley, corn and other farm subsidies from 1997 to 2004. His Horizon Organic Dairy Maryland Farm received $202,088 in dairy, corn, soybean, wheat and other farm subsidies from 1998 to 2005.

Penny Pritzker, U.S. Secretary of Commerce

Net worth: $2.2 billion

Her Chicago Mill & Lumber Co. received $1,604,288 in cotton, soybean, corn, sorghum, wheat, rice, oat and other farm subsidies from 1996 to 2006.

Charles Schwab, founder of brokerage firm Charles Schwab Corporation

Net worth: $5.1 billion

Schwab received $525,593 in rice and other farm subsidies from 1995 to 2003.

Alice and Jim Walton, Wal-Mart heirs

Net worth: $33.5 billion and $33.8 billion, respectively.

Their Robson Ranch Inc. received $261,292 in crop disaster payments, wheat, soybean, corn and other farm subsidies from 1995 to 2008.

Leslie Wexner, CEO of L Brands Inc., which owns Victoria's Secret

Net worth: $5.7 billion

His LAW Plantation Co. LLC received $209,717 in wheat, corn, sorghum and oat subsidies from 1997 to 2003.

Original Article

Source: huffingtonpost.com

Author: Jason Linkins

No comments:

Post a Comment