The growing gap between rich and poor affects all of us, but it's

hammering middle-aged Americans the most, with dire implications for

their ability to save for retirement.

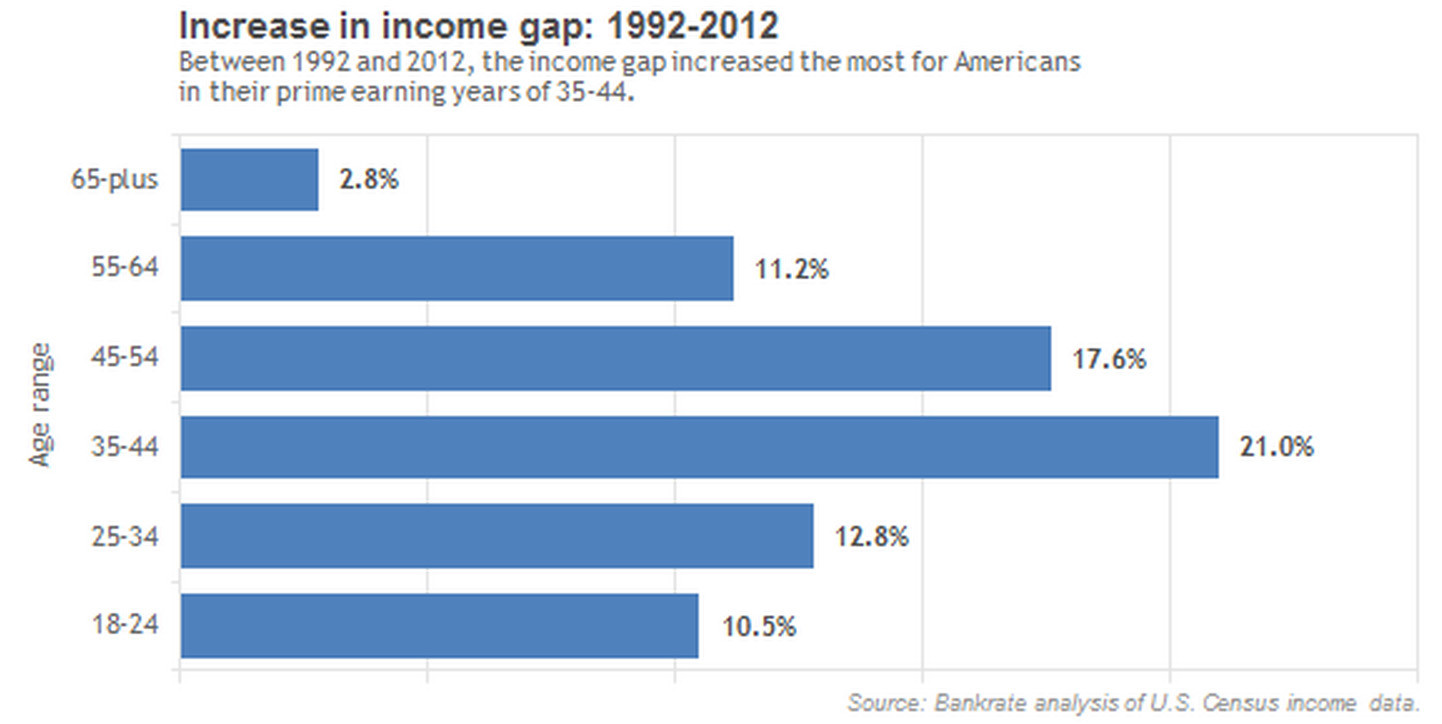

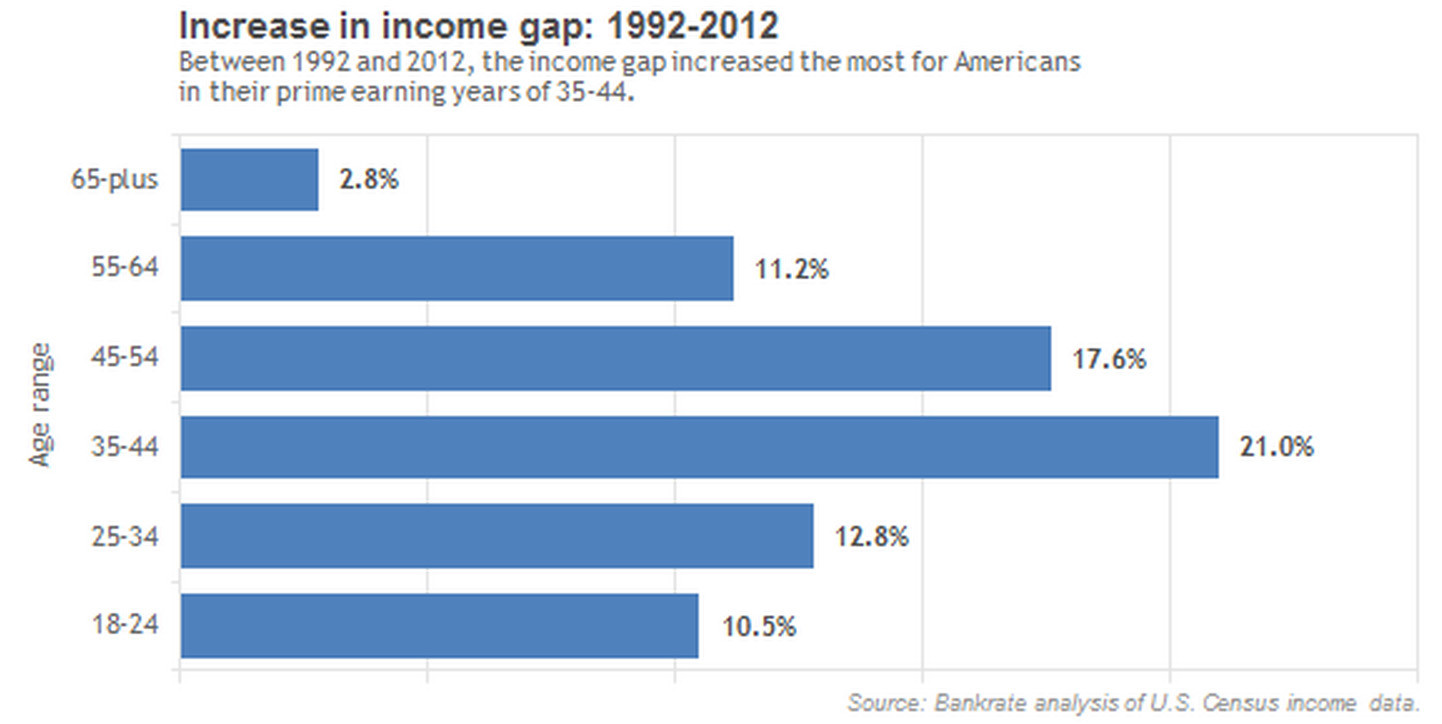

The rise in income inequality in the past 20 years has been sharpest among people between the prime earning ages of 35 and 54, according to a new analysis of Census data by Bankrate, a financial news service. Because those years of life are supposed to be prime years for wealth creation and retirement planning, this suggests inequality will haunt these Americans for the rest of their lives. (Story continues after Bankrate chart.)

The income gap for Americans aged 35-44 is a hefty 21 percent wider than it was 20 years ago, according to Bankrate, compared with less than 3 percent for people aged 65 and older and less than 11 percent for people aged 18-24.

The Great Recession caused many middle-aged workers to lose high-paying mid-career jobs and suffer plunging home prices that eroded their wealth, Bankrate noted. Not only does that contribute to inequality, but it also makes it less likely that these workers have enough saved to survive their retirement.

"If you handle that period well, it sets the course for the next decade; if you don't, in many cases you can't recover," Jason Flurry, president of Legacy Partners Financial Group, told Bankrate.

Original Article

Source: huffingtonpost. com/

Author: --

The rise in income inequality in the past 20 years has been sharpest among people between the prime earning ages of 35 and 54, according to a new analysis of Census data by Bankrate, a financial news service. Because those years of life are supposed to be prime years for wealth creation and retirement planning, this suggests inequality will haunt these Americans for the rest of their lives. (Story continues after Bankrate chart.)

The income gap for Americans aged 35-44 is a hefty 21 percent wider than it was 20 years ago, according to Bankrate, compared with less than 3 percent for people aged 65 and older and less than 11 percent for people aged 18-24.

The Great Recession caused many middle-aged workers to lose high-paying mid-career jobs and suffer plunging home prices that eroded their wealth, Bankrate noted. Not only does that contribute to inequality, but it also makes it less likely that these workers have enough saved to survive their retirement.

"If you handle that period well, it sets the course for the next decade; if you don't, in many cases you can't recover," Jason Flurry, president of Legacy Partners Financial Group, told Bankrate.

Original Article

Source: huffingtonpost. com/

Author: --

No comments:

Post a Comment