If you aren't already horrified by Comcast's recent $45 billion buyout of rival provider Time Warner Cable, you should be.

Source: huffingtonpost.com/

Author: The Huffington Post | by Kevin Short

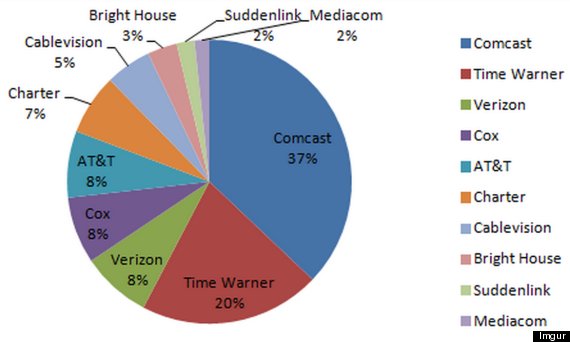

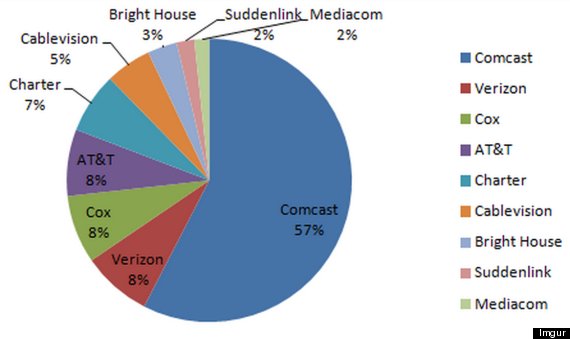

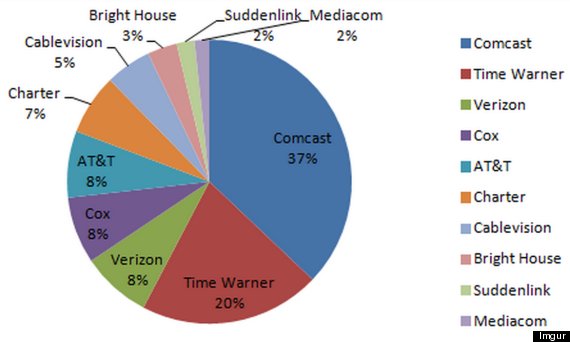

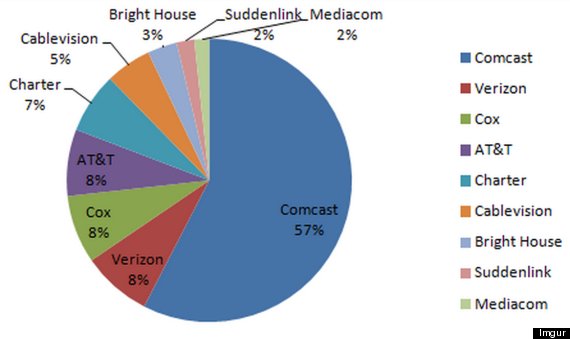

As you can see from the chart below, a merger would mean Comcast would control more than half of all American cable subscribers.

Originally posted on Reddit, the data comes from the National Cable & Telecommunications Association, the trade association for the cable industry.

Pre-buyout cable landscape:

Post-buyout quasi-monopoly:

According to some experts, this majority could mean slower speeds and fewer good choices on streaming services like Netflix, Amazon and Hulu. Because Comcastconsiders Netflix a competitor, the company doesn't have any reason to put effort into remedying congestion and the slow speeds it produces on these streaming services. A company as big as the one in the graph above might also pressure content providers not to offer their shows to its competitors, leaving us with fewer good choices when we fire up our streaming services.

And of course, a company that doesn't have to work for millions of new subscribers may not be that interested in lowering prices. Some predict prices will inevitably rise for consumers if the merger goes through.

Good luck binge-watching House Of Cards, America.

Original Article

Source: huffingtonpost.com/

Author: The Huffington Post | by Kevin Short

No comments:

Post a Comment