George Osborne has come under pressure to raise the 40p income tax threshold in order to help the "middling professionals" affected by it.

Source: huffingtonpost.co.uk/

Author: The Huffington Post UK | By Asa Bennett

Former Tory chancellor Lord Lawson said the 40p tax, which kicks in at £42,150, was "intended for the rich, the well-off" but now hit those who are "neither rich nor poor".

Another ex-Tory chancellor Lord Lamont weighed in, saying that raising the threshold to £44,000 would be the "first step" to helping the "squeezed" middle classes.

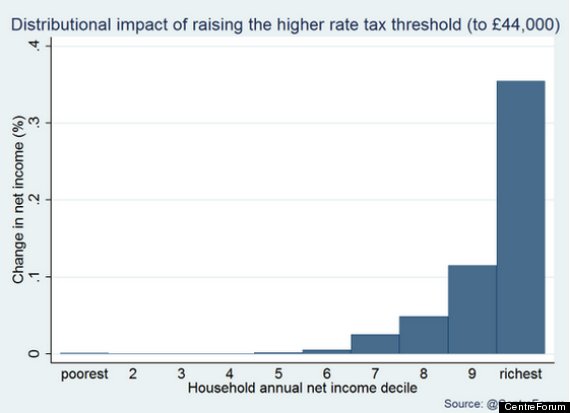

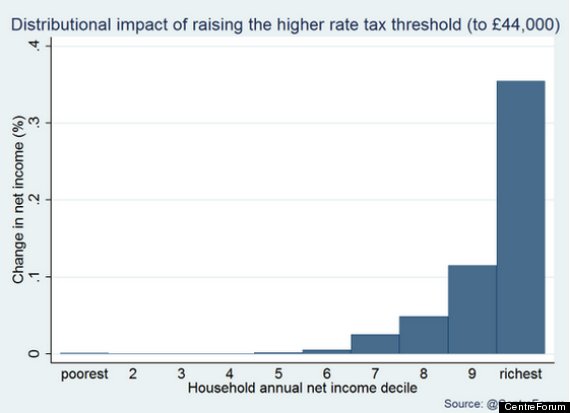

Despite Lord Lawson's claims that Osborne would be providing much-needed relief to the "middling professionals", a new analysis shows that even a tiny increase in when the 40p tax rate kicks in to £44,000 would benefit the richest most.

According to the liberal thinktank, the CentreForum, the richest fifth of Britons would get the largest benefit, while the actual "middling professionals" would get an almost negligible benefit.

Other plans like raising the income tax allowance for low earners to £12,500 are scarcely any better. Despite being billed as a "workers' bonus" that would help the poorest, the Institute for Fiscal Studies found that such a move would help the richest half of Britons.

Original Article

Source: huffingtonpost.co.uk/

Author: The Huffington Post UK | By Asa Bennett

No comments:

Post a Comment