The most dysfunctional Congress in U.S. history has finally found something that can attract bipartisan support: an expensive package of tax breaks that mostly benefit corporate interests.

By a vote of 96-3, the Senate this week advanced an $85 billion bundle of breaks known as "extenders," so named because they supposedly expire every two years. In reality, these breaks have become an all-but-permanent part of the tax code, costing the Treasury billions of dollars a year in lost revenue. Though the House has introduced rival legislation, some version of the Senate bill is likely to win final passage.

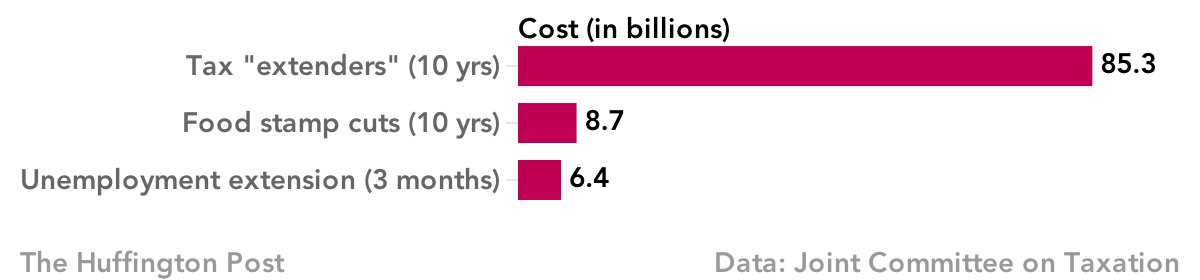

The tax breaks advanced without any corresponding spending cuts elsewhere in the budget, despite previous demands by Republicans that any new legislation must not increase the federal deficit. They passed even as Republicans, often preaching fiscal responsibility, have forced cuts to food stamps and refused to extend long-term unemployment benefits, measures that would cost much less than the buffet table of giveaways contemplated under the bill.

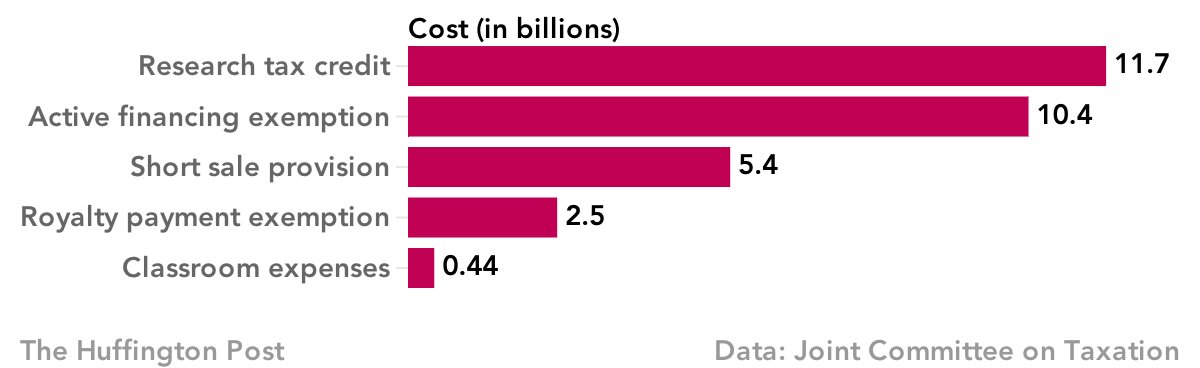

Included in the $85 billion proposal is an expensive break used primarily by large multinational companies with lending arms, such as General Electric and Morgan Stanley, to avoid paying U.S. taxes on interest income earned abroad. Extending this "active financing" exemption for two years will cost $10.3 billion, according to the Joint Committee on Taxation. Another extender, the "CFC look-through," which lets companies defer paying taxes on royalty income, will cost $2.4 billion in lost revenue.

The bill also includes a bizarre collection of breaks that benefit a few wealthy interests, including millions of dollars in savings for builders of Nascar speedways and owners of race horses.

In order to attract broad support, the extenders package also renews more popular deductions, including the research and development credit, a write-off for teachers who buy school supplies and a break that lets homeowners sell at a loss without incurring a big tax bill. (Not everyone marched in lockstep: the only votes against the Senate bill came from three Tea Party-affiliated Republicans).

Here's a breakdown of the 10-year projected cost of a few of these tax breaks.

House Republicans have proposed legislation even more tilted toward corporate interests. Six separate bills would make permanent the offshore measures and other costly deductions, at a price of $310 billion. Some version of the Senate bill, however, is most likely to win final approval.

This outcome is likely fine with the hordes of lobbyists who collect large salaries by convincing their patrons that their favored tax break is forever in danger of being eliminated. Overall, 1,359 individual lobbyists representing 373 companies and trade associations reported lobbying on extenders between January 2011 and September 2013, according to Citizens for Tax Justice, a tax reform group. That is more than 1 in 10 of all lobbyists registered in Washington in 2013, the group found.

Clarification: An earlier version of this story suggested the extender bill had passed the Senate in a final vote. In fact, it only passed an early procedural test, and on Thursday it got hung up when Republicans filibustered the bill for procedural reasons. It is still widely expected to pass.

Original Article

Source: huffingtonpost.com/

Author: Ben Hallman

No comments:

Post a Comment