The steep drop in oil prices in recent months will cost Canada’s federal government as much as $3 billion in lost revenue, according to an analysis from BMO.

Source: huffingtonpost.ca/

Author: The Huffington Post Canada | By Daniel Tencer

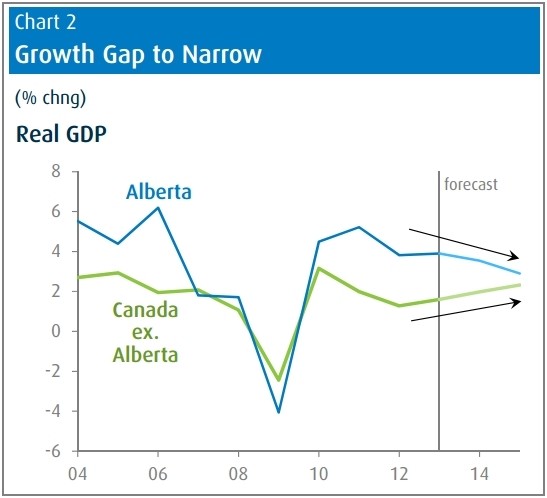

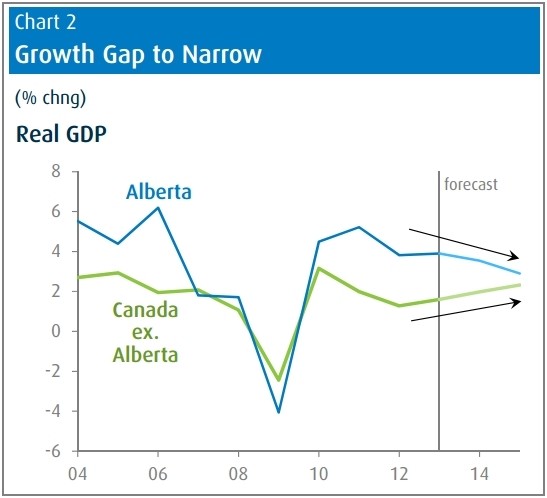

Economists Douglas Porter and Robert Kavcic forecast a “a re-ordering of the regional growth ladder” in Canada if oil prices remain low.

While lower oil prices will drag down economic growth in oil-producing provinces, those lower prices will be a benefit to central Canada and other parts of the country that primarily consume oil.

Lower energy prices will act as an “instantaneous tax cut” that will spur economic growth, helped along by a lower dollar, Porter and Kavcic write.

That means the massive economic advantage Alberta has enjoyed will narrow, while the rest of the country will catch up somewhat. BMO’s projections show economic growth in Alberta slowing to within range of the national average:

(Story continues below)

But because Canada is a net exporter of oil, lower oil prices will have an overall negative effect on the economy, the BMO economists say.

Lower corporate taxes will take some $3 billion out of the federal government’s coffers, they estimate. That would be just enough to wipe out the contingency cushion the government builds into its budget.

But “the most direct hit, not surprisingly, will be on provincial finances,” Porter and Kavcic write.

Alberta, Saskatchewan and Newfoundland are all basing their budget forecasts on expectations Brent crude would trade at around $105. It was trading at $84.65 as of Monday morning.

CIBC economist Peter Buchanan estimated a few weeks ago that, at current oil prices,Alberta would be out $1.2 billion annually in government revenue.

OILSANDS ‘THE BIGGEST LOSER’

Many analysts note that Canada’s oil industry has been relatively unaffected, so far, by the slide in oil prices. That’s mainly because Canadian oil has been selling at a discount to other North American oil supplies, and that gap has been narrowing.

But a new study from the Carbon Tracker Initiative (CTI) identifies Alberta’s oilsands as the biggest loser in the oil game as a result of falling oil prices, Bloomberg reported Monday.

The study suggests many new oilsands projects may have had an overly optimistic view of future oil prices. Projects from ConocoPhillips, ExxonMobil and Royal Dutch Shell would need oil to be at around $150 a barrel to turn a profit, the study found.

And a large majority of Canadian oil supply requires oil to be in the $60-to-$80 range to be profitable, meaning many producers could be in trouble if oil prices fall further.

Original ArticleSource: huffingtonpost.ca/

Author: The Huffington Post Canada | By Daniel Tencer

No comments:

Post a Comment