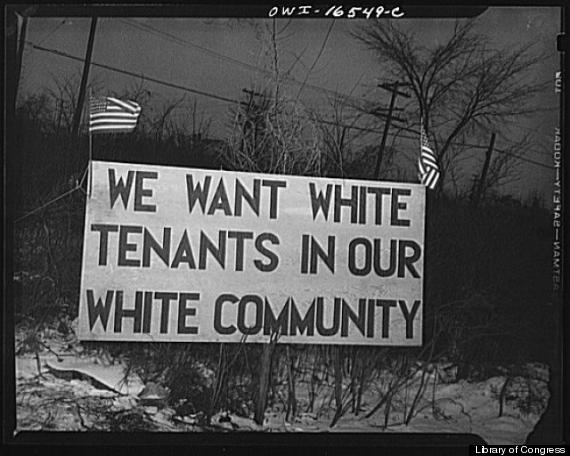

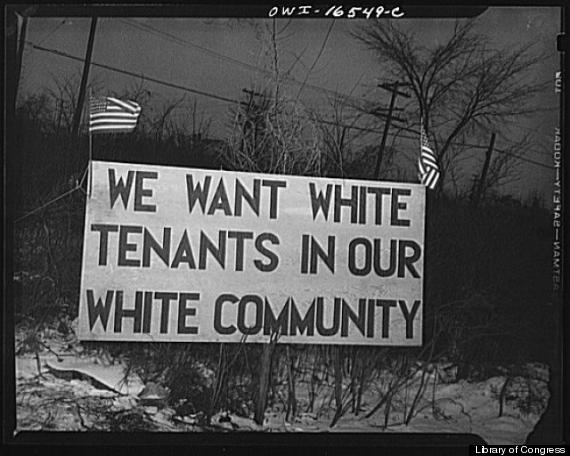

For the larger part of the 20th century, housing discrimination in the United States was overt and unambiguous. Racial segregation was largely the norm, and those who worked to preserve it were under little obligation, legal or social, to hide their intentions. At least it was easy to spot:

Source: huffingtonpost.com/

Author: Nick Wing

Across the street from a federal housing project built for black residents of Detroit in 1942. (Photo via Arthur S. Siegel/Library of Congress)

Help came in 1968 with the federal Fair Housing Act, which prohibited racial discrimination in the sale, rental and financing of homes. The law explicitly barred practices with a discriminatory intent.

The country has progressed since the late '60s, and blatant prejudice is now much less common. Yet housing discrimination persists, often due to bias built into the system. So over the years, the federal courts have expanded the Fair Housing Act to cover practices with a discriminatory outcome. Under this theory, known as "disparate impact," a policy or practice can be illegal if it disproportionately affects minorities, regardless if that was its purpose. Disparate impact claims are crucial to fighting racial inequality today.

But this key weapon could soon be taken away. The Supreme Court will likely rule this summer in a case, Texas Department of Housing and Community Affairs v. The Inclusive Communities Project, that may forbid disparate impact claims under the Fair Housing Act. Such a decision would effectively defang the law. It would also shed a disturbing light on how this court believes the law should react to entrenched discrimination.

The underlying reality of the Texas case is that certain housing policies disadvantage minorities more than whites, whether by hidden design, careless disregard or unfortunate coincidence. It's this type of discrimination -- in housing, but also employment, voting and education -- that today produces some of the biggest barriers to bridging the racial divide. If the Supreme Court acknowledges this truth and believes justice is best served by fostering equality "in fact, and not simply in form" --to borrow a phrase from Justice Ruth Bader Ginsburg -- its decision should be easy. That it probably won't be helps explain why racial inequality remains such an unrelenting problem for the nation.

Here's what you need to know about the case, its history and why it could be a landmark decision:

In the past, property owners and policymakers openly supported segregation.

During the first half of the 20th century, racially restrictive covenants were commonly used to keep minorities from moving into white neighborhoods. Under these private agreements, property owners would stipulate that their land could not be sold to or occupied by anyone who wasn't white. Sometimes, a group of neighbors would sign a contract prohibiting all current and future owners of their properties from selling or leasing to African-Americans. Violating the contract could lead to forfeiture of the property.

Local authorities also played a role in maintaining segregated neighborhoods. Though the Supreme Court had ruled that explicit racial zoning was unconstitutional in 1917, exclusionary zoning to preserve the character of a community was -- and is -- allowed. Neighborhoods can be zoned to allow only more expensive, low-density housing while prohibiting smaller homes or affordably priced apartment buildings. Because of racial differences in household wealth, many minorities are priced out of the exclusive areas. This practice, which has repeatedly been upheld by courts, is still widely used around the nation.

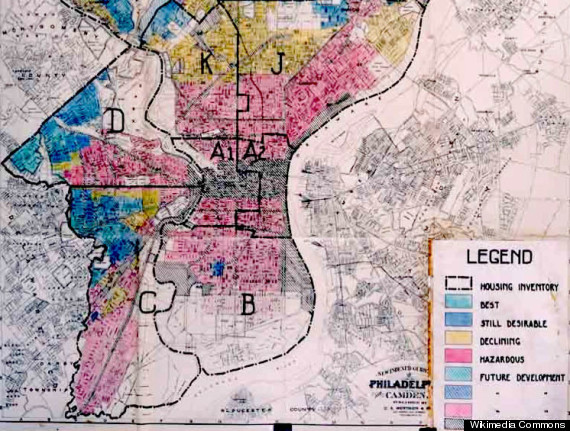

A big part of the problem was how the federal government limited minority access to mortgages.

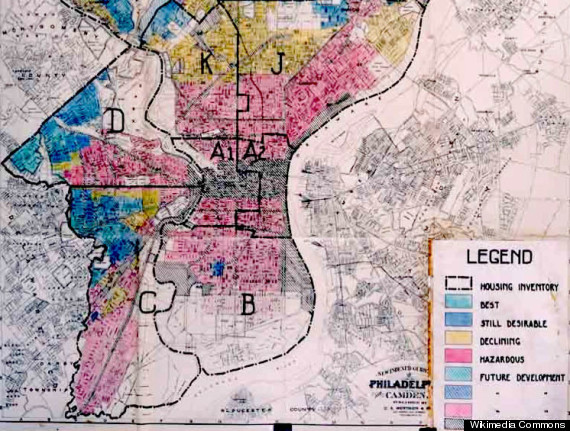

Established in 1934, the Federal Housing Administration enforced policies for decades that helped preserve segregation. Chief among these was "redlining," under which it declined to back home loans to people living in certain often-minority neighborhoods. This discouraged mortgage lenders from extending financial services to those areas. The consequences of redlining on home ownership and economic development are still apparent today in many urban areas.

A 1936 map of Philadelphia from another New Deal era federal agency, the Home Owners' Loan Corporation, identifying the neighborhoods in which lenders should and should not offer mortgages. Redlined areas are marked "hazardous."

Housing speculators capitalized on the fact that most African-American homebuyers couldn't access federally insured mortgages. In Chicago, for instance, mostly white speculators bought up cheap properties in black neighborhoods and marked up the prices, sometimes to twice what they had initially paid. These houses were sold under a contract that called for monthly payments until the entire price was paid -- and only then would the buyer receive the deed to or gain any equity in the property. If the buyer managed to pay off the contract in full, he or she owned a house in a minority neighborhood that would likely not appreciate in value. If the buyer didn't fulfill the terms of the contract, eviction with nothing to show for payments made was the usual response.

In the late 1960s, a group of black homeowners in Chicago began to fight this predatory system. A federal class-action lawsuit was filed in 1969 against speculators, contract sellers and financial institutions involved in the scheme. Activists also organized protests and holdouts, in which homeowners refused to make payments to the sellers. There were standoffs with police, arrests, negotiations, and in 1971, thanks to a policy change by regional banks and insurance companies, the homebuyers finally began converting their contracts into mortgages in large numbers.

Yet when the federal case finally went to trial in 1975, the black plaintiffs couldn't convince the mostly white jury that they had been price-gouged because of their race. As one juror reportedly concluded, "It was economics, not civil rights, in play."

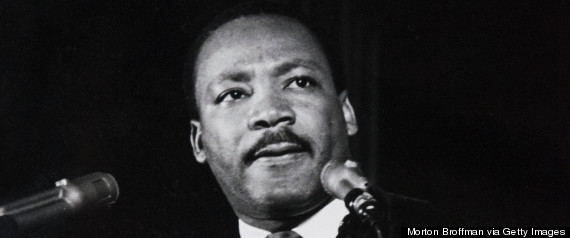

Congress passed the Fair Housing Act in 1968.

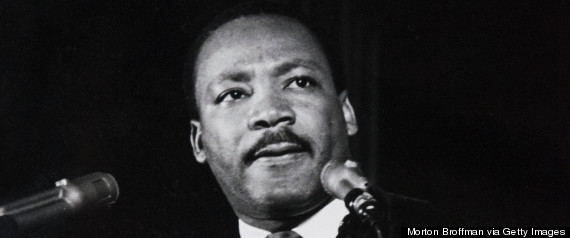

Passed just a week after Martin Luther King Jr.'s assassination, the law made it illegal to discriminate in the sale, rental or financing of housing based on race, religion and national origin. It prohibited the sort of straight-up racist language and policies long used to maintain housing segregation. The more blatant forms of redlining, for example, were banned. (Gender, familial status and disability were later added to the list of protected classes.)

Martin Luther King Jr. delivers a sermon at Washington's National Cathedral on March 31, 1968. He was killed four days later. (Photo by Morton Broffman/Getty Images)

But as the Chicago case shows, it can be hard to prove that someone was motivated by racial animus. With the aid of the courts, the Fair Housing Act has also been used to target less explicit bias. Over the past 40 years, judges have repeatedly read the statute to forbid many policies and practices with a disparate impact on minorities, even where no racist intent can be shown.

In a rule issued in February 2013, the Department of Housing and Urban Development clarified the formula for deciding disparate-impact housing cases: If the plaintiff can demonstrate that a practice has a discriminatory effect, the burden shifts to the defendant to show that the practice serves a substantial, nondiscriminatory interest that can't be served by a less discriminatory means. If the defendant meets that burden, the plaintiff can still win by showing that, in fact, there is a less discriminatory means that would serve the defendant's needs.

Note this means that a policy with a disparate impact that also has a valid justification and no less-discriminatory alternative is legal. For that reason, there are plenty of legitimate housing restrictions and requirements that disproportionately affect minorities today -- like occupancy limits, credit score standards and income verification.

Housing advocates and federal prosecutors still use the law to fight housing discrimination.

A number of high-profile disparate impact cases have been settled in the past few years alone. Many focused on financial institutions and lenders that were accused of offering less favorable rates and services, on average, to minority customers than to white customers.

In 2011, for example, mortgage giant Countrywide Financial reached a record $335 million settlement with the Department of Justice following allegations that it had charged higher fees and rates to hundreds of thousands of Hispanic and African-American customers than it had to white customers with similar financial standing. The Justice Department investigation also found that Countrywide, which was purchased by Bank of America after the alleged misconduct, had offered subprime mortgages to 10,000 minority borrowers while offering regular loans to white borrowers with similar credit profiles. Using a disparate impact argument, federal prosecutors didn't need evidence that Countrywide's practices were driven by discriminatory intent, only that they had discriminatory outcomes.

The National Fair Housing Alliance reported that 27,352 housing discrimination complaints were made nationwide in 2013. The organization estimates that at least 4 million violations actually occur each year.

It's hard to overstate the ongoing importance of access to fair housing. Decades of segregation have helped to concentrate poverty in minority neighborhoods. Communities with large percentages of black and Hispanic residents tend to havefewer economic and employment opportunities; lower-quality education; less access to medical care, healthy food and public transportation; and lower levels of public safety.

While a number of studies released over the past few years have shown some progress in urban areas, fair housing advocates say the problem is far from solved.

"While recent modest declines in black segregation levels are welcome, the 2010 census shows that the average black resident still lives in a neighborhood that is 45 percent black and 36 percent white," William Frey, chief demographer at the Brookings Institution, told The New York Times. "At the same time, the average white lives in a neighborhood that is 78 percent white and 7 percent black. Black segregation levels are even higher for children."

For more on how ZIP codes correlate with opportunity, check out this tool created by Opportunity Nation and Measure of America.

Abandoned houses in Detroit, which consistently ranks among the most segregated U.S. cities. (Photo by Carlos Osorio/AP)

Even with disparate impact claims, the government has often done a poor job fostering housing equality.

The persistence of segregated communities suggests, at least in part, a decades-long failure at the Department of Housing and Urban Development. A lengthy 2012 report by ProPublica reported that HUD had injected billions of dollars into communities without vigorously enforcing the Fair Housing Act:

HUD's largest program of grants to states, cities and towns has delivered $137 billion to more than 1,200 communities since 1974. To receive the money, localities are supposed to identify obstacles to fair housing, keep records of their efforts to overcome them, and certify that they do not discriminate.ProPublica could find only two occasions since [George] Romney's tenure [as HUD secretary, ending in 1972,] in which the department withheld money from communities for violating the Fair Housing Act. In several instances, records show, HUD has sent grants to communities even after they've been found by courts to have promoted segregated housing or been sued by the U.S. Department of Justice. New Orleans, for example, has continued to receive grants after the Justice Department sued it for violating that Fair Housing Act by blocking a low-income housing project in a wealthy historic neighborhood.

The Supreme Court is now debating whether disparate impact claims can even be raised in housing cases.

On Jan. 21, the justices heard oral arguments in Texas Department of Housing and Community Affairs v. The Inclusive Communities Project. The Dallas-area nonprofit, which promotes racially and economically diverse communities, filed suit after finding that for the past few decades, the Texas housing department had allocated almost all affordable-housing tax credits to developments in minority neighborhoods, while denying credits to those in white neighborhoods. This effectively kept low-income residents from moving to white communities. The nonprofit is raising a disparate impact claim under the Fair Housing Act.

The Texas agency, unable to show there was no less-discriminatory alternative to its practice, lost the case in federal district court and in the U.S. Court of Appeals for the 5th Circuit. It petitioned the Supreme Court to rule for the first time on the overall permissibility of disparate impact claims under the Fair Housing Act. Court watchers suggest the decision may come down to Justice Antonin Scalia, who during oral arguments indicated sympathy with both sides.

Opponents argue that disparate impact claims are unfair to policymakers, financial institutions and property owners. If housing policies and practices are instituted for legitimate reasons based on race-neutral criteria, the basic argument goes, then they should be legal despite any unintended discriminatory effects -- and the people who implement those policies and practices should not be blamed.

During oral arguments, Texas Solicitor General Scott Keller suggested another problem: that housing officials and developers wary of possible Fair Housing Act lawsuits might make race-conscious decisions in favor of minorities, creating "the functional equivalent of a quota system." This would raise constitutional issues of its own.

Other critics have expressed concerns that the idea of disparate impact is too fluid -- that just because a practice unevenly affects a minority group doesn't mean that it harms the group or that it doesn't help other minority groups.

Supporters of disparate impact think the law is on their side, if not necessarily the justices.

Since 1974, 11 federal circuit courts have upheld an interpretation of the Fair Housing Act that allows for disparate impact claims. Moreover, in 1988, when Congress amended the statute, it chose not to add language ruling out such claims, but it did include language that implied their use.

Amicus briefs have flooded in -- from lawmakers, public interest advocates and business interests -- seeking to sway the justices. There are 14 supporting the Texas agency and 23 backing the nonprofit. One brief in favor of the Inclusive Communities Project comes from the federal government, 17 states and an assortment of civil rights groups.

"This was really the last legislative victory of the civil rights movement, and it was Dr. King's last victory, too," Philip Tegeler, executive director of the Poverty & Race Research Action Council, told The Washington Post. "This is the message that Dr. King brought to Chicago in 1966, talking about de facto segregation in the North, segregation wherever it exists -- that we need to address it. That’s in large part what the Fair Housing Act was trying to do."

Fair housing advocates remain concerned -- in part because this is the third time the Supreme Court has agreed to consider disparate impact claims under the Fair Housing Act in less than four years. The two earlier cases were each settled less than a month before they were heard by the justices. Civil rights groups, which pushed for those settlements, worry that the justices' eagerness to rule on this issue could spell trouble.

"It is unusual for the court to agree to hear a case when the law is clearly settled. It's even more unusual to agree to hear the issue three years in a row," Ian Haney López, a law professor at the University of California, Berkeley, told ProPublica.

A Supreme Court ruling against disparate impact would cap a string of controversial civil rights decisions.

"The way to stop discrimination on the basis of race is to stop discriminating on the basis of race," Chief Justice John Roberts wrote in a 2007 decision on school desegregation in Seattle. That sounds simple enough, but such a focus on explicit racial preferences overlooks the issues of structural discrimination -- the kind found in housing and other areas today.

In 2009, the Supreme Court declared that New Haven, Connecticut, had violated the civil rights of white firefighters when it threw out a promotion exam that no black firefighter had passed. The city took the racial gap in exam results as a sign that the test itself might violate employment protections under the Civil Rights Act, but the court ruled against New Haven. In 2013, the Supreme Court gutted a key section of the Voting Rights Act that determined which states had to obtain pre-approval from the federal government before making changes to their voting systems. And last year, the justices upheld a Michigan ban on affirmative action, declaring that a state's voters can prohibit the use of race as a factor in college admissions.

As ProPublica noted, a ruling against disparate impact claims this year would give the Roberts Court a dubious hat trick: It would have effectively undermined the three most substantial civil rights laws of the 1960s -- the 1964 Civil Rights Act, the 1965 Voting Rights Act and the 1968 Fair Housing Act.

Whatever the Supreme Court decides in the current case, some of the justices are clearly unconvinced that discrimination not driven by overt bias is a problem, or at least one that the law should take a stand against.

Justice Sonia Sotomayor spoke to this troubling pattern last year in her dissent in the Michigan affirmative action case. "The way to stop discrimination on the basis of race is to speak openly and candidly on the subject of race, and to apply the Constitution with eyes open to the unfortunate effects of centuries of racial discrimination," she said, responding to Roberts' quote from seven years earlier.

Sotomayor, one of only two racial minorities on the high court, chose to read aloudher dissent, something the justices do only when they feel particularly strongly.

A ruling in Texas Department of Housing and Community Affairs v. The Inclusive Communities Project is expected sometime in June.

Original Article

Source: huffingtonpost.com/

Author: Nick Wing

No comments:

Post a Comment