It wasn’t that long ago that Canadians were congratulating themselves, however quietly, on weathering the Great Recession better than most developed nations — and especially better than the U.S., where a prolonged job crisis took hold in the wake of the 2008 financial collapse.

Source: huffingtonpost.ca/

Author: Daniel Tencer

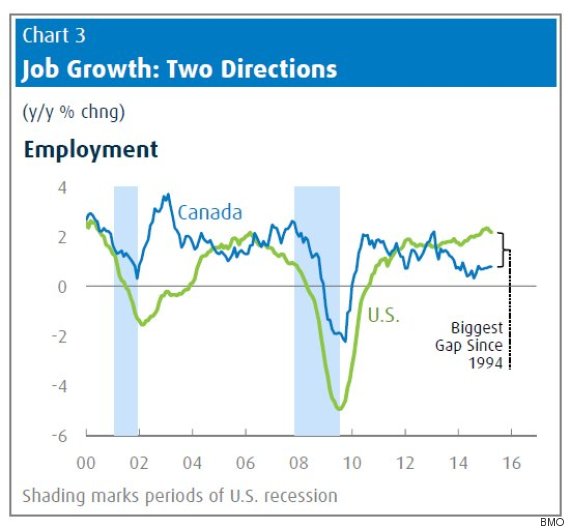

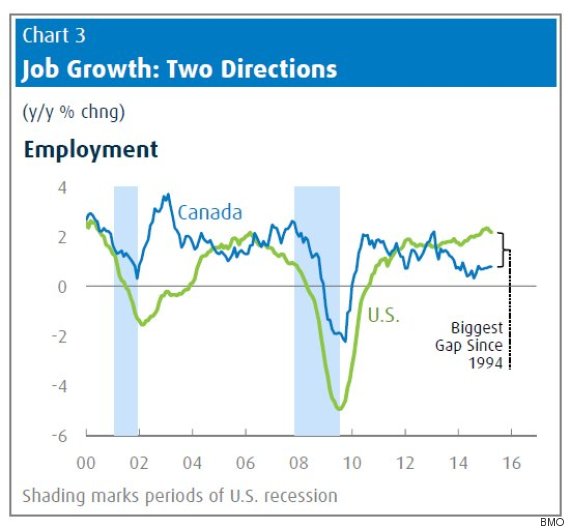

But fast forward to 2015 and the great oil price crash, and the tables have turned — so much so that Canada’s job market is now underperforming the U.S.’s by margins not seen in decades.

In a report issued Friday, Bank of Montreal chief economist Doug Porter noted that jobs in Canada are up a tepid 0.8 per cent to 1 per cent over the past year, with the country logging job losses in eight of the last 17 months.

Compare that to the U.S., where job growth has been on the fastest tear since the peak of the dot-com boom in the late 1990s: The number of private sector jobs south of the border expanded by 2.5 per cent in the past year.

The U.S. hasn’t outpaced Canadian job growth by that wide a margin since 1994, Porter notes. At that time, Canada was struggling with a decline in manufacturing, crippling public debts and a long-running housing slump.

Of course, the job situation in Canada isn’t as desperate today as it was then, when the national unemployment rate stayed persistently above 10 per cent. Canada's unemployment rate sits at 6.8 per cent, but that compares to 5.4 per cent in the U.S. Adjusting for the different way unemployment is measured in the U.S., Canada's unemployment rate is 6 per cent, still well above the U.S.

Porter notes that some of the U.S.’s success in creating jobs has to do with the fact the U.S. is starting lower; thanks to the financial crisis, the U.S. has had a lower portion of its working-age population working than Canada, by about three percentage points.

All the same, BMO has “serious doubts on Canada’s economic outlook” right now.

“With the plunge in oil and weakness in many other commodities, Canada is now casting for new growth engines,” Porter writes.

“While consumers and housing have done yeomen-like work in the past decade … the record level of household debt simply means that those sectors can’t be counted on to lead the charge in the years ahead.”

Strengthening U.S. imports were supposed to offset the crash in oil prices for Canada’s economy, but that hasn’t materialized yet, Porter notes. “Export volumes have been down over the past two quarters.”

Despite the U.S.’s strong job growth, its economy contracted in the first quarter of the year, helping to take Canada’s down with it. Canada’s economy shrank at an annualized pace of 0.6 per cent in the first quarter, according to StatsCan data released Friday, and BMO has again revised its forecast for growth downwards for 2015, to 1.5 per cent.

The Canadian economy will “tread water until U.S. growth kicks into gear again,” Porter concludes.

“While we continue to believe that a rebound will unfold in coming months, events so far this year have clearly proved what we contended a year ago: This is the Unluckiest. Recovery. Ever.”

Original Article

Source: huffingtonpost.ca/

Author: Daniel Tencer

No comments:

Post a Comment