Finance Minister Joe Oliver denied it on Friday, but a growing number of economic analysts now say Canada is in a recession.

Finance Minister Joe Oliver denied it on Friday, but a growing number of economic analysts now say Canada is in a recession.

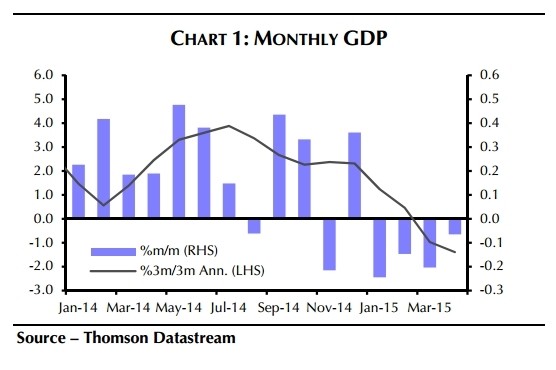

The country's economy likely shrank at an annual rate of 0.6 per cent in the second quarter of this year, Bank of America Merrill Lynch economist Emanuella Enenajor said Thursday, as quoted at Bloomberg.

That’s the same pace of contraction that StatsCan says Canada saw in the first quarter. As a rule of thumb, two consecutive quarters of shrinking GDP constitute a recession.

Canada “is likely in recession," echoed Nomura Securities economist Charles St-Arnaud, as quoted at AFP. He estimates Canada’s economy shrank at an annual pace of 0.5 per cent from April to June.

The pessimistic forecasts come after StatsCan data earlier this week showed Canada’s economy shrank 0.1 per cent in April, well below economists’ consensus call for a 0.1 per cent expansion.

That means Canada’s economy started the year by shrinking for four months straight. To avoid a recession at this point, the country would have to see strong growth of 0.2 per cent and 0.3 per cent in May and June, CIBC economist Benjamin Tal wrote Friday.

And given the forest fires that shut down large swaths of the oilsands in May, that poses a challenge, and "a technical recession is a real possibility," he wrote.

Canada's economy has shrunk for four straight months.

The Bank of Canada “needs to cut rates sooner rather than later,” David Madani of Capital Economics wrote Friday, joining a growing chorus of analysts who are calling for more stimulus. He said he believes Canada “probably slipped into a technical recession” in the first half of this year.

And while Bank of Canada Governor Stephen Poloz has said the shock from the oil price collapse would be “front-loaded” and Canada would quickly recover, Madani -- a noted bear who has been calling for a housing market correction -- thinks the worst is yet to come.

“In Canada's case, the enormous investments in the oil sands that fuelled the booming construction sector for the past few years are now drying up rather rapidly, which will soon hit suppliers in other sectors and regions,” he wrote.

The Canadian Association of Petroleum Producers forecasts that capital spending in oil and gas in Canada will fall by 40 per cent this year, to around $45 billion.

But Finance Minister Joe Oliver poured cold water over recession predictions Friday.

"First off, we're not in a recession. We don't believe we will be in a recession," he said at an event in Toronto, as quoted by CTV News.

"A recession, technically, as you know, is two quarters (of negative economic growth), and we don't have results from the second quarter."

Results from the second quarter will be in on September 1, when StatsCan releases the GDP data for June, giving us a full picture of second-quarter economic growth.

A negative reading indicating a recession would be poorly timed for the Harper government, which faces a likely October election and has built an image as a competent steward of the economy.

But a recession is by no means certain. And in a note Friday, the Bank of Montreal suggested Canada won't be in a recession -- even if it meets the technical definition of a recession.

"A recession is a sustained, broad-based decline in economic activity. Canada simply does not meet that test," BMO chief economist Doug Porter wrote.

"Auto and home sales are strong, homebuilding is solid, and the weakness in output is heavily concentrated by industry (resources) and region (Alberta and Saskatchewan)."

Porter noted that Canada added 102,000 jobs in the first five months of the year, while the unemployment rate has come down to 6.8 per cent, from above 7 per last year.

That's "hardly indicative of a recession," he wrote. And while he expects some pullback in job growth for May, "the bigger employment picture in Canada is consistent with a sluggish economy, not one in recession."

Original Article

Source: huffingtonpost.ca/

Author: Daniel Tencer

No comments:

Post a Comment