Gas prices are giving Canadians very little relief from a rocky economy, says a recent report from the Bank of Canada.

Gas prices are giving Canadians very little relief from a rocky economy, says a recent report from the Bank of Canada.

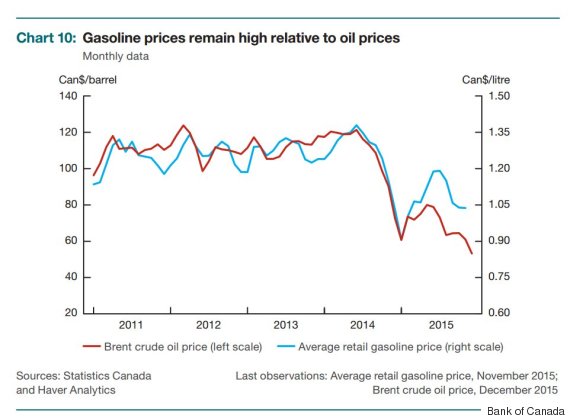

The central bank's Monetary Policy Report contains a chart showing that Canadian gas prices remain relatively high compared to the falling price of oil.

"Although gasoline prices have declined, they have not fallen as much as the reduction in crude oil prices would suggest, based on historical experience," the report reads.

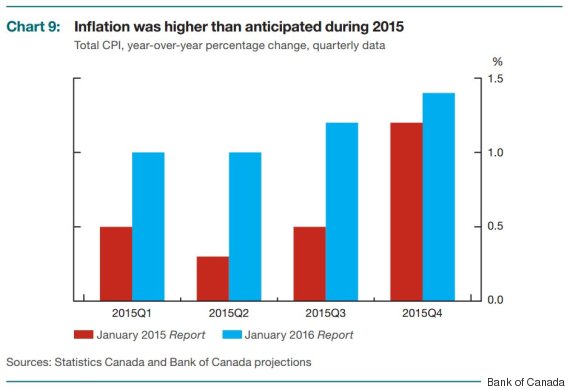

The price of gas was one of two factors that led to inflation in the consumer price index (CPI), a measure that looks at price changes in goods and services such as food, health care and transportation.

When the CPI goes up, it means the cost of living is growing in turn. And another Bank of Canada chart shows that this is precisely what happened in 2015.

The reason that gas prices remain high is that refineries are taking a larger share of the profit pie, The Toronto Star reported.

Economist Robyn Allan analyzed historical refinery and marketing margins and found that they accounted for an average of 17.7 cents per litre of gasoline from 2004 to 2014.

Those margins grew to an average of 28.9 cents per litre in 2015 and to 32.3 cents in the first weeks of 2016.

"An average of 11.2 cents per litre more was charged in 2015 and that's pure profit," she told the newspaper.

Customers at a Shell station at Richmond and Parliament Streets in Toronto. (Photo: Steve Russell/Toronto Star via Getty Images)

The falling Canadian dollar also means that oil refineries are having to pay more for the product that they make into gasoline, and that cost is being downloaded on to customers, Peter McKnight, an energy analyst with En-Pro International, told Global News.

Major oil companies that extract oil, refine it and then sell it at the pumps, like Shell and Suncor, are also protecting their bottom line by keeping prices higher.

"The consumer at the pump is really subsidizing the financial stability of the upstream of the integrated oil companies," McKnight said.

"The consumer at the pump is really subsidizing the financial stability of the upstream of the integrated oil companies."

Gas prices are, on average, lower today than they've been in the past four years.

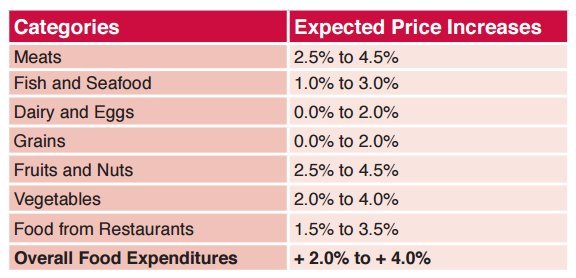

But any savings at the pump are being offset by higher food prices, Carleton University economics professor Ian Lee said last week.

"The percentage of our budget that goes to transportation is much smaller than the percentage of our budget that is consumed in food," he said.

The University of Guelph's Food Institute forecasts that overall food expenses could jump by four per cent this year.

The University of Guelph's Food Institute issued this forecast for food prices for 2016. (Photo: Food Institute)

"So much of what we buy as a consumer is imported," York University business professor Perry Sadorsky said.

"A lower dollar just makes the cost of importing more expensive."

Original Article

Source: huffingtonpost.ca/

Author: Jesse Ferreras

No comments:

Post a Comment