Three things don't add up in the British Columbia budget when it comes to declining revenues from the battered shale gas industry and its non-existent cousin, the province's liquefied natural gas fantasy.

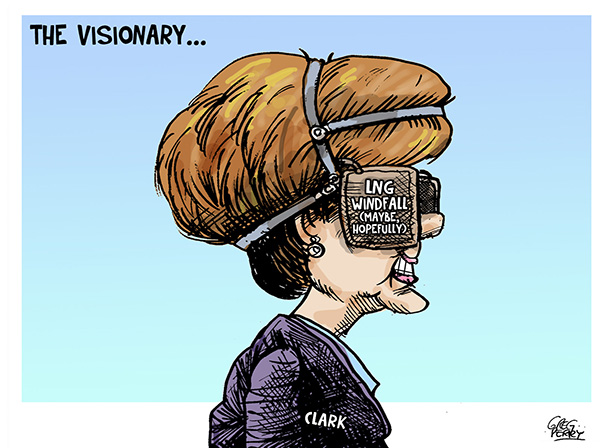

The first concerns revenue. Premier Christy Clark promised in 2013 that profits from the LNG industry would pour like manna into a $100-billion provincial prosperity fund.

In the months before the election that year, the government persuaded citizens that a complex, high-cost and foreign-owned industry, tied to a volatile greenhouse gas, could somehow make the province debt-free and bless it with Alberta-like prosperity.

Twenty LNG proponents all lined up at the government trough, expecting low royalties and taxes. But not one of the 20 proponents has committed to go ahead with a LNG project, because the economic justification has vanished in a sea of volatility. Many are folding, such as the Douglas Channel LNG project, because of what industry calls "unfavourable market conditions."

New LNG terminals in Australia, Papua New Guinea and Angola have created an oversupply while demand is falling in key markets like Japan, South Korea and China due to economic stagnation. Prices for LNG are expected to remain in the tank for years or become as volatile as oil.

No matter. Faced with her pet industry's dire prospects, Premier Clark took $100 million, about what the province will bring in through higher Medical Services Plan premiums, and boldly placed those hard-won tax dollars into B.C.'s newly created LNG prosperity fund.

Clark is trying to preserve the illusion of a revenue stream that doesn't exist. In so doing, her government has out-Orwelled Orwell with some very creative explanations.

"The fact that we would take a small amount of the chequing account and transfer it into a small savings account to look ahead is a natural thing for us to do," said Finance Minister Mike De Jong, sounding like a character in Alice in Wonderland. It is about as natural as robbing a bank.

Drilling leases deflated

The second thing that doesn't add up is the claim that the shale gas industry made $767 million last year for B.C. citizens, the owners of the resource, from the sale of drilling leases. This number is an accounting fiction (actually approved by the auditor general back in 2005) due to something called "bonus bid auction sales."

At the beginning of the shale gas boom nearly a decade ago, the B.C. government made billions selling drilling leases in northeastern B.C. and on Treaty 8 Nation land -- often without proper consultation or cumulative impact studies. (Last month, the province didn't record one sale in its drilling auctions -- perhaps a provincial first.)

Most citizens will be surprised to learn that the province actually doesn't make much money from mining shale gas because it continues to subsidize the industry with among the lowest royalties in North America (more on that later).

But the province did make cash from selling off shale gas real estate in the boom years. From 2006 to 2015, shale gas leases accounted for between 29 and 68 per cent of the province's total income from oil and gas.

These one-time windfalls reflected a crazy resource boom driven by the brute force technology of hydraulic fracturing.

That boom, which attracted sale prices of $3,500 per hectare, has now gone bust (try less than $200 a hectare) due to collapsed methane prices, oversupply and a highly indebted shale gas industry. Many firms, such as Encana, have written off billions of dollars of their shale gas assets and are now laying off significant percentages of their workforce.

In fact, North America's frackers, sustained by cheap credit and low royalties, often spent more on drilling and fracking deep horizontal wells than they ever earned back in methane volume or revenue.

Bloomberg reported the truth last year: "The shale sector is now being financially stress-tested by low prices, exposing shale's dirty secret: many shale producers outspend cash flow and thus depend on capital market injections to fund ongoing activity."

In B.C., taxpayers prop up the sector with low royalties, royalty credits, virtually free water for fracking and other perks.

The province didn't earn $767 million from land sales for shale gas last year. That figure, as government small print admits, refers to "deferred cash sales representing one-ninth of the cash from the annual bonus bid auction sales in each of the previous eight years."

In reality, the province earned about $18 million from the sale of drilling rights last year.

But by extending a previous and long-gone windfall over nine years, the province can still create the illusion that shale gas is making money for its owners -- even when it clearly is not. (Vaughn Palmer nicely explains the accounting in a recent column, noting the auditor general recommended that the government do business in this way in 2005.)

But reality is catching up. The budget details note that, "Over the next three years, revenue from the sale of Crown land tenures is forecast to decline 65 per cent from $767 million in 2015/16 to $268 million in 2018/19."

That's when the "bonus bid land auction" accounting balloon deflates.

Some startling numbers

The last thing that British Columbians might want to ponder is why Medical Service Plan premiums are increasing while citizens are subsidizing the highly indebted shale gas industry.

Here are some startling numbers from the budget. The government says, for example, that it will make $151 million in royalties from natural gas this year. In fact, royalties from methane, which at one time exceeded forestry revenues, have been falling faster than the value of the loonie.

But that's only part of the story. What looks like a modest win for the owners of the resource rapidly becomes a case of negative numbers when you consider what industry gets back in royalty credits.

For 2015/2016, taxpayers will provide the largely foreign-owned industry approximately $186 million in deep drilling credits and road and infrastructure assistance. The math leaves taxpayers $35 million in the red.

Next year won't be much better. The province will earn $129 million from the struggling industry, but give back $132 million in credits and incentives.

The pattern will not change in 2018/2019 either.

According to the B.C. budget, the province will earn $247 million from the industry only to give back $333 million. That's an $86 million cost for taxpayers to support Malaysian-owned companies like Petronas. (Petronas could use the credit. According to the Wall Street Journal, the company that makes fracking-induced earthquakes in northern B.C. slashed its operating budget by $11 billion due to low oil prices.)

But this is not free enterprise or even smart enterprise. Since 2008, the government has lowered royalties and increased incentives to compensate for falling natural gas prices.

As a result, the volume of natural gas extraction in B.C. has risen from 25 billion cubic metres a year in 2002 to 44 billion cubic metres today, despite depressed prices for natural gas.

These corporate subsidies are beginning to add up. According to the B.C. auditor general's 2014 summary financial statements report, the province delivered $587 million in incentives to the fracking industry that year and $412 million in 2013. The payments were all deducted from royalties.

These corporate gifts represent a Third World model of industry development. Persistent low royalties combined with other subsidies encourage reckless over-development in a market already flooded with cheap methane.

Alberta pursued exactly the same path with bitumen, and today it wobbles like Humpty Dumpty on a hydrocarbon wall of fragility.

One subsidized boondoggle

For 2016/17, the government says that it will make $633 million from bonus bids (land sold years ago) and $128 million from royalties, for total revenue of $761 million.

But the $633 million, as explained, is an accounting invention that reflects a resource boom now long dead. It reflects almost no current earnings. So that leaves $128 million in royalties. But that figure is cancelled out by $132 million given back to industry in credits.

As a consequence, the industry is not really earning taxpayers one bloody cent. Add the cost of damages by the fracking industry to groundwater, roads, forests, wildlife and Treaty 8 First Nations, and you have one subsidized resource boondoggle.

And here's one more insult to reflect on. To entice LNG magnates whose firms have been convicted of tax evasion or other scandals to come to B.C., the government lowered and then locked in a low LNG tax rate and regulatory regime for 25 years. If any future government seeks to make changes (God forbid that LNG prices should rise), the taxpayer is now on the hook for that, too.

Even the budget says so: "If government makes changes to any of these very specific taxes or regulatory requirements and if those changes are material, the province may be required to provide compensation under the project development agreements."

Such agreements make British Columbia something worse than a Third World country.

Original Article

Source: thetyee.ca/

Author: Andrew Nikiforuk

The first concerns revenue. Premier Christy Clark promised in 2013 that profits from the LNG industry would pour like manna into a $100-billion provincial prosperity fund.

In the months before the election that year, the government persuaded citizens that a complex, high-cost and foreign-owned industry, tied to a volatile greenhouse gas, could somehow make the province debt-free and bless it with Alberta-like prosperity.

Twenty LNG proponents all lined up at the government trough, expecting low royalties and taxes. But not one of the 20 proponents has committed to go ahead with a LNG project, because the economic justification has vanished in a sea of volatility. Many are folding, such as the Douglas Channel LNG project, because of what industry calls "unfavourable market conditions."

New LNG terminals in Australia, Papua New Guinea and Angola have created an oversupply while demand is falling in key markets like Japan, South Korea and China due to economic stagnation. Prices for LNG are expected to remain in the tank for years or become as volatile as oil.

No matter. Faced with her pet industry's dire prospects, Premier Clark took $100 million, about what the province will bring in through higher Medical Services Plan premiums, and boldly placed those hard-won tax dollars into B.C.'s newly created LNG prosperity fund.

Clark is trying to preserve the illusion of a revenue stream that doesn't exist. In so doing, her government has out-Orwelled Orwell with some very creative explanations.

"The fact that we would take a small amount of the chequing account and transfer it into a small savings account to look ahead is a natural thing for us to do," said Finance Minister Mike De Jong, sounding like a character in Alice in Wonderland. It is about as natural as robbing a bank.

Drilling leases deflated

The second thing that doesn't add up is the claim that the shale gas industry made $767 million last year for B.C. citizens, the owners of the resource, from the sale of drilling leases. This number is an accounting fiction (actually approved by the auditor general back in 2005) due to something called "bonus bid auction sales."

At the beginning of the shale gas boom nearly a decade ago, the B.C. government made billions selling drilling leases in northeastern B.C. and on Treaty 8 Nation land -- often without proper consultation or cumulative impact studies. (Last month, the province didn't record one sale in its drilling auctions -- perhaps a provincial first.)

Most citizens will be surprised to learn that the province actually doesn't make much money from mining shale gas because it continues to subsidize the industry with among the lowest royalties in North America (more on that later).

But the province did make cash from selling off shale gas real estate in the boom years. From 2006 to 2015, shale gas leases accounted for between 29 and 68 per cent of the province's total income from oil and gas.

These one-time windfalls reflected a crazy resource boom driven by the brute force technology of hydraulic fracturing.

That boom, which attracted sale prices of $3,500 per hectare, has now gone bust (try less than $200 a hectare) due to collapsed methane prices, oversupply and a highly indebted shale gas industry. Many firms, such as Encana, have written off billions of dollars of their shale gas assets and are now laying off significant percentages of their workforce.

In fact, North America's frackers, sustained by cheap credit and low royalties, often spent more on drilling and fracking deep horizontal wells than they ever earned back in methane volume or revenue.

Bloomberg reported the truth last year: "The shale sector is now being financially stress-tested by low prices, exposing shale's dirty secret: many shale producers outspend cash flow and thus depend on capital market injections to fund ongoing activity."

In B.C., taxpayers prop up the sector with low royalties, royalty credits, virtually free water for fracking and other perks.

The province didn't earn $767 million from land sales for shale gas last year. That figure, as government small print admits, refers to "deferred cash sales representing one-ninth of the cash from the annual bonus bid auction sales in each of the previous eight years."

In reality, the province earned about $18 million from the sale of drilling rights last year.

But by extending a previous and long-gone windfall over nine years, the province can still create the illusion that shale gas is making money for its owners -- even when it clearly is not. (Vaughn Palmer nicely explains the accounting in a recent column, noting the auditor general recommended that the government do business in this way in 2005.)

But reality is catching up. The budget details note that, "Over the next three years, revenue from the sale of Crown land tenures is forecast to decline 65 per cent from $767 million in 2015/16 to $268 million in 2018/19."

That's when the "bonus bid land auction" accounting balloon deflates.

Some startling numbers

The last thing that British Columbians might want to ponder is why Medical Service Plan premiums are increasing while citizens are subsidizing the highly indebted shale gas industry.

Here are some startling numbers from the budget. The government says, for example, that it will make $151 million in royalties from natural gas this year. In fact, royalties from methane, which at one time exceeded forestry revenues, have been falling faster than the value of the loonie.

But that's only part of the story. What looks like a modest win for the owners of the resource rapidly becomes a case of negative numbers when you consider what industry gets back in royalty credits.

For 2015/2016, taxpayers will provide the largely foreign-owned industry approximately $186 million in deep drilling credits and road and infrastructure assistance. The math leaves taxpayers $35 million in the red.

Next year won't be much better. The province will earn $129 million from the struggling industry, but give back $132 million in credits and incentives.

The pattern will not change in 2018/2019 either.

According to the B.C. budget, the province will earn $247 million from the industry only to give back $333 million. That's an $86 million cost for taxpayers to support Malaysian-owned companies like Petronas. (Petronas could use the credit. According to the Wall Street Journal, the company that makes fracking-induced earthquakes in northern B.C. slashed its operating budget by $11 billion due to low oil prices.)

But this is not free enterprise or even smart enterprise. Since 2008, the government has lowered royalties and increased incentives to compensate for falling natural gas prices.

As a result, the volume of natural gas extraction in B.C. has risen from 25 billion cubic metres a year in 2002 to 44 billion cubic metres today, despite depressed prices for natural gas.

These corporate subsidies are beginning to add up. According to the B.C. auditor general's 2014 summary financial statements report, the province delivered $587 million in incentives to the fracking industry that year and $412 million in 2013. The payments were all deducted from royalties.

These corporate gifts represent a Third World model of industry development. Persistent low royalties combined with other subsidies encourage reckless over-development in a market already flooded with cheap methane.

Alberta pursued exactly the same path with bitumen, and today it wobbles like Humpty Dumpty on a hydrocarbon wall of fragility.

One subsidized boondoggle

For 2016/17, the government says that it will make $633 million from bonus bids (land sold years ago) and $128 million from royalties, for total revenue of $761 million.

But the $633 million, as explained, is an accounting invention that reflects a resource boom now long dead. It reflects almost no current earnings. So that leaves $128 million in royalties. But that figure is cancelled out by $132 million given back to industry in credits.

As a consequence, the industry is not really earning taxpayers one bloody cent. Add the cost of damages by the fracking industry to groundwater, roads, forests, wildlife and Treaty 8 First Nations, and you have one subsidized resource boondoggle.

And here's one more insult to reflect on. To entice LNG magnates whose firms have been convicted of tax evasion or other scandals to come to B.C., the government lowered and then locked in a low LNG tax rate and regulatory regime for 25 years. If any future government seeks to make changes (God forbid that LNG prices should rise), the taxpayer is now on the hook for that, too.

Even the budget says so: "If government makes changes to any of these very specific taxes or regulatory requirements and if those changes are material, the province may be required to provide compensation under the project development agreements."

Such agreements make British Columbia something worse than a Third World country.

Original Article

Source: thetyee.ca/

Author: Andrew Nikiforuk

No comments:

Post a Comment