One of the world's most respected financial institutions just issued a warning asserting the world is facing a "gathering storm" caused by excessive borrowing.

The Bank for International Settlements says central banks like the Bank of Canada and the U.S. Federal Reserve are running out of policy room and have been "over-burdened'' over the past few years.

The BIS is referred to as the "central bank of central banks" — it provides banking services to central banks. Former Bank of Canada governor and current Bank of England governor Mark Carney sits on its board.

Its chief economist, Claudio Borio, said market participants have registered the fact that central banks are running out of options, and their "confidence in central banks' healing powers has — probably for the first time — been faltering.''

"We may not be seeing isolated bolts from the blue, but the signs of a gathering storm that has been building for a long time,'' Borio added.

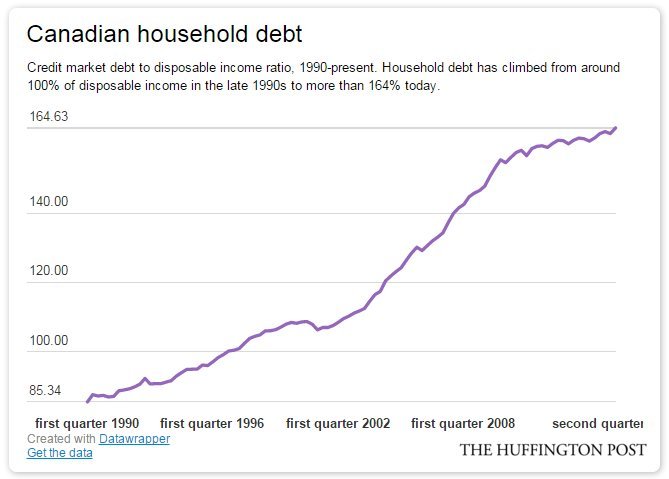

The BIS in 2014 listed Canada as one of a handful of countries with an elevated risk of a banking crisis caused by excessive debt. It said Canadians' debt had been growing some 5.6 per cent faster in recent years than it should have been, given historical norms.

"Credit extended during a phase of rapid credit growth could conceal problem loans, leading to financial instability when the boom turns to bust," the bank said.

Its concerns aren't limited to Canada. The BIS warned last fall that the stock market crash in China was a sign that debt build-up all over the world is beginning to come back to haunt markets. It warned that rate hikes at the U.S. Federal Reserve -- the first one of which we saw in December -- could tip the world into a debt crisis.

Many central banks have been looking to add firepower to their monetary toolbox by dropping key interest rates below zero. There is little agreement among experts whether negative interest rates have been effective in boosting economies.

While European markets reacted negatively to the BIS' comments, with bourses across the EU down on Monday, there was little reaction in North America. The S&P 500 and Dow Jones Industrial Average were largely unchanged as of mid-morning Monday.

The Toronto Stock Exchange was up a solid 150 points, or 1.13 per cent, largely due to oil prices hitting a three-month high.

Original Article

Source: huffingtonpost.ca/

Author: Daniel Tencer

The Bank for International Settlements says central banks like the Bank of Canada and the U.S. Federal Reserve are running out of policy room and have been "over-burdened'' over the past few years.

The BIS is referred to as the "central bank of central banks" — it provides banking services to central banks. Former Bank of Canada governor and current Bank of England governor Mark Carney sits on its board.

Its chief economist, Claudio Borio, said market participants have registered the fact that central banks are running out of options, and their "confidence in central banks' healing powers has — probably for the first time — been faltering.''

"We may not be seeing isolated bolts from the blue, but the signs of a gathering storm that has been building for a long time,'' Borio added.

The BIS in 2014 listed Canada as one of a handful of countries with an elevated risk of a banking crisis caused by excessive debt. It said Canadians' debt had been growing some 5.6 per cent faster in recent years than it should have been, given historical norms.

"Credit extended during a phase of rapid credit growth could conceal problem loans, leading to financial instability when the boom turns to bust," the bank said.

Its concerns aren't limited to Canada. The BIS warned last fall that the stock market crash in China was a sign that debt build-up all over the world is beginning to come back to haunt markets. It warned that rate hikes at the U.S. Federal Reserve -- the first one of which we saw in December -- could tip the world into a debt crisis.

Many central banks have been looking to add firepower to their monetary toolbox by dropping key interest rates below zero. There is little agreement among experts whether negative interest rates have been effective in boosting economies.

While European markets reacted negatively to the BIS' comments, with bourses across the EU down on Monday, there was little reaction in North America. The S&P 500 and Dow Jones Industrial Average were largely unchanged as of mid-morning Monday.

The Toronto Stock Exchange was up a solid 150 points, or 1.13 per cent, largely due to oil prices hitting a three-month high.

Original Article

Source: huffingtonpost.ca/

Author: Daniel Tencer

No comments:

Post a Comment