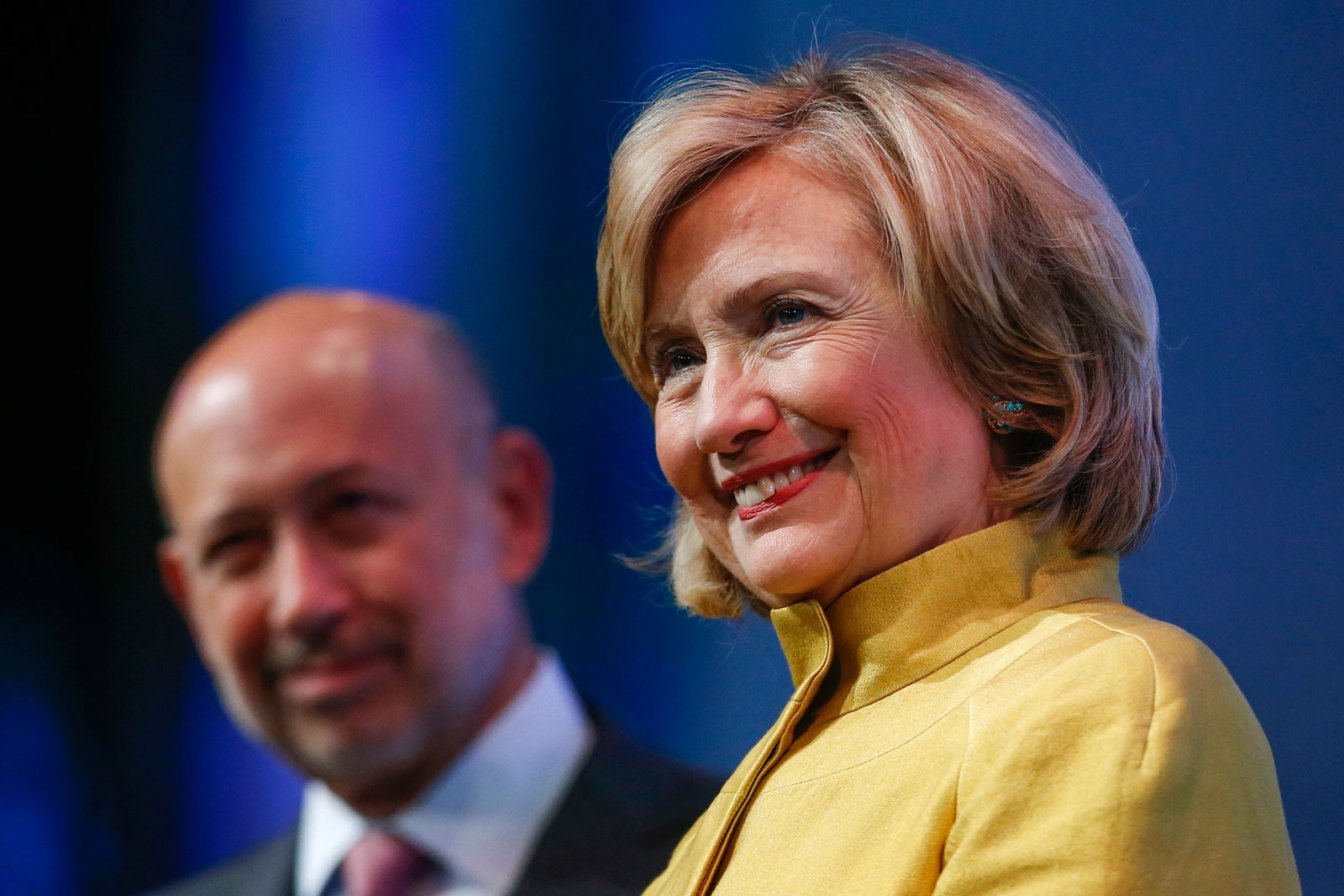

Why is Hillary Clinton refusing to release the transcripts of her Goldman Sachs speeches? After losing eight of the last nine contests to Bernie Sanders, Clinton is trying to reassure voters that she is a reform-minded politician who can be trusted. Yet she has repeatedly refused requests to make public the texts of the three speeches she gave to executives of the Goldman Sachs investment bank in the fall of 2013, for which she was paid a total of $675,000. First she said she would look into it; then she said that she would release the transcripts only if all the other presidential candidates of both parties released the paid speeches they had given. What does she have to hide?

In a February 25 editorial, The New York Times argued that Clinton’s “stonewalling” on the Goldman transcripts “plays into the hands of those who say she’s not trustworthy and makes her own rules” and “most important, is damaging her credibility among Democrats who are begging her to show them that she’d run an accountable and transparent White House.” But the Times editorial did not get to the heart of the matter. The larger question is, Why was she giving these speeches at all—and accepting such hefty payments for them—given Goldman Sachs’s record during the Great Recession of 2007–2008?

Set alongside such stricken competitors as Lehman Brothers and Bear Stearns, Goldman and its CEO Lloyd Blankfein are the great survivors of the crash: they actually came out ahead in their own derivatives trading during those years. Goldman and Blankfein’s admirers, including many in the financial media, have for the most part ignored the bank’s activities during the crash, despite multiple investigations and billion-dollar penalties against Goldman for its aggressive and deceptive marketing of financial derivatives. This has included a $5 billion settlement levied against the bank this January. How does this fit with Clinton’s self-portrayal as an opponent of the big banks and their excesses who is committed to their reform?

On the stump, Clinton’s criticisms of Wall Street can sound as radical as Bernie Sanders’s or Senator Elizabeth Warren’s. During a CNN debate with Bernie Sanders in March, Clinton said that she was in agreement that, “no bank is too big to fail, and no executive too powerful to jail” and that she has “the tools” to do it. In its earlier endorsement of Clinton in January, The New York Times itself highlighted her “proposals for financial reform” and her support for “controls on high-frequency trading and stronger curbs on bank speculation in derivatives,” which it cited as evidence that “she supports changes that the country badly needs.”

Yet Clinton’s repeated dealings with Goldman Sachs and its top executives since the financial crisis—including the 2013 speeches and more recent events involving the Clinton Foundation—run counter to such claims. To understand the significance of these dealings we have to bring together two strands of history. One concerns Bill and Hillary Clinton’s long-running connections to Goldman, among their closest with any US corporation. The second concerns Goldman’s activities leading up to and during the Wall Street crash of 2007–2008, including its deceptive marketing of contaminated mortgage derivatives.

The Clintons’ connections to Goldman Sachs can be traced back to their beginnings in national politics, in December 1991, when Robert Rubin, then co-chair co-senior partner of the bank, met Bill Clinton at a Manhattan dinner party and was so impressed by him that he signed on as an economic adviser to Clinton’s campaign for the 1992 Democratic nomination. According to a November 2015 survey of Clinton donors by The Washington Post, Rubin and other Goldman partners “mobilized their networks to raise money for the upstart candidate.”

As Bill Clinton’s secretary of the treasury from January 1995 until July 1999, Rubin was an architect of the financial deregulation that left financial derivatives such as Collateralized Debt Obligations (CDOs) largely free of controls. This paved the way for the large-scale, unregulated speculation in financial derivatives by Wall Street banks beginning in the early 2000s. (Goldman itself continued to enjoy special access to Washington during the George W. Bush administration, with former Goldman chief executive Hank Paulson serving as Treasury Secretary from 2006 to 2009.)

These long-running ties with Goldman have paid off for the Clintons. According to a July 2014 analysis in the Wall Street Journal, from 1992 to the present Goldman has been the Clintons’ number one Wall Street contributor, based on speaking fees, charitable donations, and campaign contributions, the three pillars of what I’ve called the Clinton System. As early as 2000, Goldman was the second most generous funder—after Citigroup—of Hillary Clinton’s 2000 Senate campaign, with a contribution of $711,000. In the early 2000s, Bill Clinton was also a Goldman beneficiary, receiving $650,000 from Goldman for four speeches delivered between December 2004 and June 2005. (The transcripts of these speeches do not appear to be currently available.)

By the winter of 2006–2007, however, Goldman and its CEO Lloyd Blankfein were becoming deeply involved in the collapsing housing bubble—and engaging in the practices that have since resulted in years of investigations and lawsuits. Data gathered mostly from the Corporate Research Project, a public interest website, show that on thirteen occasions between 2009 and 2016, Goldman was penalized by US courts or government agencies for fraudulent or deceptive practices that were committed mostly between 2006 and 2009. Four of these penalties amounted to $300 million or more.

In July 2010 the Securities and Exchange Commission fined Goldman $550 million for the fraudulent marketing of its Abacus CDO; the bank had allowed its client John Paulson to stuff the CDO with toxic ingredients, mostly in the form of mortgage-backed securities (MBSs), and then to bet against the CDO when it was marketed by taking a short position. Paulson earned around $1 billion when the CDO lost value as it was designed to do. In August 2011 the Federal Housing Finance Agency sued Goldman for “negligent misrepresentation, securities laws violations and common fraud” in its dealings with the semi-public mortgage banks Fannie Mae and Freddie Mac. In August 2014 Goldman agreed as restitution to buy back $3.15 billion worth of securities it had sold to the two banks for $1.2 billion more than they were currently worth.

In July 2012 Goldman agreed to pay $25.6 million to settle a suit brought by the Public Employees Retirement System of Mississippi accusing the bank of defrauding investors in a 2006 offering of MBSs. In January 2013, the Federal Reserve announced that Goldman would pay $330 million to settle allegations of foreclosure abuse by its mortgage loan servicing operations. Finally, in January of this year, Goldman announced that it would pay $5 billion to settle multiple lawsuits brought by official agencies against the bank, mainly for fraudulent marketing of CDOs; the final terms of the settlement were released on April 11. (Through the availability of tax credits and allowances, Goldman may end up paying less.) Among the plaintiffs were the Department of Justice, the New York and Illinois Attorneys General, the National Credit Union Administration, and the Federal Home Loan Banks of Chicago and Seattle.

These are summary descriptions of Goldman transgressions, which do no more than point to a pattern of deceptive and often fraudulent trading in derivatives. To get a more detailed sense of what exactly the bank was doing with these trades, we have to look at Goldman’s own record of its behavior during the crash. This record, which is now in the public domain, provides a stark backdrop to Clinton’s recent dealings with Goldman. The story begins on December 14, 2006 when David Viniar, Chief Financial Officer at Goldman and thus number four in the Goldman hierarchy, convened a meeting on the thirtieth floor of Goldman’s Manhattan headquarters. This was the seat of power where, along with Viniar, the bank’s Big Three had their offices: CEO Lloyd Blankfein, and co-vice presidents Gary Cohn and Jon Winkelried.

At the meeting Viniar called for an in-depth review of Goldman’s holdings of mortgage backed securities because its “position in subprime mortgage related assets was too long, and its risk exposure was too great.” The next day Viniar emailed a subordinate about the deteriorating housing markets, its effect on mortgage-backed securities, and not only the risks but also the opportunities this opened up. In his email Viniar alerted his subordinates to the possibility that the bank could profit from the deterioration of its own assets: “My basic message was let’s be aggressive distributing things because there will be very good opportunities as the markets [go] into what is likely to be even greater distress and we want to be in a position to take advantage of them.”

By February 11, 2007, Goldman CEO Lloyd Blankfein himself was urging Goldman’s mortgage department to get rid of deteriorating assets: “Could/should we have cleaned up these books before and are we doing enough right now to sell off cats and dogs in other books throughout the division”? But this was no easy task. In 2006 and 2007 Goldman created 120 complex financial derivatives, relying heavily on subprime mortgages grouped together in MBSs and CDOs with a total value of around $100 billion.

The problem was that the derivatives Goldman was busy creating were clogged with assets that were rapidly losing value. Faced with what it saw as a collapsing market, especially in MBSs, Goldman abandoned some derivatives that were still “under construction” while liquidating others that were fully formed, selling off their components in the markets. If this is all Goldman had done—anticipating where the market was going and unloading its bad assets—it would not have been the target of multiple lawsuits, and Blankfein might rightly be esteemed on Wall Street as the great survivor of the crash.

But Goldman also persisted with the creation of new CDOs and MBSs and continued marketing its existing ones so that they too could become part of new CDOs. Although the trading strategies involved in these maneuvers were sometimes highly complex, the motive underlying them was not. The bank’s executives believed that they could make more money by repackaging their collapsing assets into new CDOs and MBSs, which they could still market to clients as investment opportunities. Crucially, in doing this, Goldman was not simply acting as a “market maker,” an institutional trader that simply buys and sells securities at publicly posted prices. By marketing these new financial products, Goldman was also acting as underwriter and placement agent for them, and as such was subject to additional rules on fair disclosure.

On multiple occasions, as the Federal Housing Finance Agency’s 2011 lawsuit alleged, Goldman failed to disclose to its own clients how risky many of its derivatives were and that the bank itself was betting against them by taking the short position. At a hearing in April 2010 before the Senate Permanent Subcommittee on Investigations, Senator Carl Levin of Michigan confronted Blankfein about these practices:

Senator Levin: Is there not a conflict when you sell something to somebody and then are determined to bet against that same security and you don’t disclose that to the person you are selling it to? Do you see a problem?

Blankfein: In the context of market making, that is not a conflict. What clients are buying, or customers are buying, is they are buying an exposure. The thing that we are selling to them is supposed to give them the risk they want. …

Senator Levin: How about [if] you are investing in these securities. This isn’t a market making deal. This is where you have a decision to bet against, to take the short side of a security that you are selling, and you don’t think that there is any moral obligation here? …

Blankfein: Every transaction Senator, and that is—and I think it is important, and again, I am not trying to be resistant but to make sure your terminology—when as a market maker, we are buying from sellers and selling to buyers. …

Levin: You are betting against that same security you are out selling. I have just got to keep repeating this. I am not talking about generally in the market. I am saying you have got a short bet against that security. You don’t think the client would care?

Blankfein: I don’t—Senator, I can’t speak to what people would care. I would say that the obligations of a market maker are to make sure your clients are suitable and to make sure they understand it. But we are a part of a market process. We do hundreds of thousands, if not millions of transactions a day as a market maker.

As the force behind the 2010 Senate hearings and report, Senator Levin performed a great public service by bringing to light so much revealing information about the role of Goldman Sachs and other banks in the crash of 2007–2008. But at this critical moment in the hearing, Levin missed the crucial flaw in Blankfein’s defense: in marketing CDOs and MBSs to its clients, Goldman was not simply a market maker. It was an underwriter and placement agent that had manifestly violated rules of disclosure about the suitability of its products for its clients. This explains why Blankfein, in his exchanges with Levin, clung so desperately to the claims that he and Goldman were never more than humble market makers.

The Levin committee’s own investigation found extensive evidence that Goldman was more than a market maker in much of its trading activity during the crash. Consider the sales history of one Goldman product, its “Timberwolf” CDO, which it marketed between March and July 2007, a time when, as we have seen, Goldman’s executives had concluded that the US mortgage market was under growing distress. With a marketing value of $1 billion, the Timberwolf CDO gave investors the right to receive the income flows from interest payments on mortgages and other forms of debt held by the CDO, such as corporate, consumer, and student debt. (I discuss the history of Timberwolf in my 2014 book, Mindless: Why Smarter Machines Are Making Dumber Humans.)

As underwriter and placement agent for Timberwolf, Goldman produced a pitch book for clients that claimed that it was structured to “generate positive performance for the benefit of both debt and equity investors” and had “an objective of zero loss for CDO debt investments.” Yet Goldman emails subpoenaed by the Levin committee show that at the exact moment the bank was making this sales pitch, senior Goldman executives, including Blankfein, knew that the real market value of Timberwolf’s underlying assets was much lower, and that they were aiming to unload as much of the CDO as they could before it lost even more value.

On May 11, 2007, Daniel Sparks, then head of Goldman’s Mortgage Department, emailed a subordinate about Timberwolf: “I posted senior guys that I felt there is a real issue.…We are going to have a very large markdown [i.e. loss]…multiple hundreds.” (In trading jargon, the hundred here referred to is one dollar—one hundred cents—but a loss of “multiple hundreds” is still a big deal.) A week later the Mortgage Department’s analysts reported that “based on a small sample of single-A CDOs for which we have a complete underlier marks…the price of the A2 tranche of Timberwolf would actually be 35-41 cents on the dollar, depending on the correlation.”

By mid-June 2007, Sparks and Goldman’s Australian sales agent were trying to offload $100 million of Timberwolf assets as fast as they could to a local client, Basis Capital. The choice of an Australian client was significant. Goldman’s US clients were by then wary of Timberwolf; as of the second week of May the bank had made only one Timberwolf sale during the previous several weeks. This dearth of sales led Goldman to target what it called “nontraditional” clients “that can take larger bit size than traditional CDO buyers.” These included “Asian banks and insurance companies,” among them the Korean insurance company Hungkuk Life in Seoul, as well as Bank Hapoalim in Tel Aviv and Basis Capital in Sydney.

Unlike Goldman’s major US clients, these foreign clients may not yet have been aware of the rapid collapse of subprime markets in the US, and would be more receptive to the claims of Goldman’s Timberwolf pitch book. But there was no telling how long this ignorance would last, and Goldman’s global sales force was subject to a full-court press from Goldman’s top executives in New York City to move quickly; Blankfein was clearly aware of this. On June 13 Goldman’s salesman in Sydney received an anxious email from Sparks saying: “Let me know if you need help tonight…I’d love to tell the senior guys on 30”—the thirtieth floor at Goldman’s headquarters in New York City where Blankfein had his office—“at risk comm[ittee] Wednesday that you moved 100mm [$100 million].” Meanwhile, as the Timberwolf price collapsed, one party that had taken a 36 percent share of the bet against it was coming out well ahead: Goldman.

How have the Clintons responded to these revelations about Goldman Sachs, and their legal repercussions for the bank? Since we do not have the transcripts of Clinton’s 2013 speeches, it is impossible fully to answer this question. But we do know that Clinton received $675,000 from the bank for the speeches and all indications are that the Clinton-Goldman connections continued much as they had before the crash. Eyewitness accounts of Hillary Clinton’s 2013 Goldman speeches give some idea of their tone. One Goldman executive told Politico in early February that Clinton sounded “like a Goldman Sachs managing director,” while a report in The Wall Street Journal on February 11 quoted another unnamed source who said Clinton’s greetings toward her Goldman audiences “bordered on ‘gushy.’” These accounts are suggestive but no more than that.

A third indication of Hillary Clinton’s recent approach to Goldman executives, however, is more substantial. This is a speech Hillary Clinton gave to Goldman executives, including CEO Lloyd Blankfein, on September 23, 2014, that is available on YouTube. It took place during the annual meeting of the Clinton Global Initiative (CGI) in New York, of which Goldman has been a leading sponsor. In her comments, Clinton held up Goldman as an outstanding corporate citizen that was supporting a CGI initiative to promote the role of women in the global workforce: “It is really exciting for me to be here and to look around this room and see so many people who are committed to this mission that we share, certainly from the business world led by Goldman Sachs.”

Nor are these the only indications of the Clintons’ continued close ties to Goldman. After the $650,000 he received from Goldman in 2004–2005 Bill Clinton received another $600,000 from the bank between 2006 and 2014, including $200,000 in 2011 at a time when the bank was lobbying Hillary Clinton’s State Department for changes in the Budget Control Act. The final bill included the reauthorization of the Export-Import Bank, which helped finance a company in which Goldman was a part-owner. In 2011 the Clinton Foundation decided to leave its Harlem offices on West 125th Street in Manhattan, and moved downtown to a Goldman building on Water Street. Three years later, in May 2014, when the Clintons convened their leading donors to discuss the foundation’s future plans, they chose Goldman’s corporate headquarters in Lower Manhattan as the venue. In her current campaign for president, Hillary Clinton has hired Gary Gensler, a former Goldman banker and former chairman of the Commodity Futures Trading Commission, as her chief financial officer.

Finally, at the time of publication of this article, I have yet to discover any comment by Hillary Clinton on the $5 billion fine against Goldman Sachs announced in January, with the details finalized this week. In the words of Stuart F. Delery, the acting associate attorney general, “This resolution holds Goldman Sachs accountable for its serious misconduct in falsely assuring investors that securities it sold were backed by sound mortgages, when it knew that they were full of mortgages that were likely to fail.”

As the primary season reaches the crucial contests in the northeast and in California that will likely decide the ultimate victor, the dual history linking Goldman and the Clintons poses two questions that still need to be answered. First, should Lloyd Blankfein remain CEO of Goldman Sachs in view of the bank’s central involvement in the deceptive marketing of securities during the crash? Second, should he, and Goldman, remain the valued associates of Hillary Clinton, with both Clintons receiving inflated speaking fees from Goldman, and with Hillary Clinton performing what amounts to a high-end public relations effort for the bank, even as she styles herself as a reformer of the financial industry? As long as Clinton refuses to reveal the content of her Goldman speeches, the suspicion will remain that she has cast a blind eye on Goldman’s dark years and that her campaign pledge to “rein in Wall Street” cannot be taken seriously.

Original Article

Source: nybooks.com/

Author: Simon Head

In a February 25 editorial, The New York Times argued that Clinton’s “stonewalling” on the Goldman transcripts “plays into the hands of those who say she’s not trustworthy and makes her own rules” and “most important, is damaging her credibility among Democrats who are begging her to show them that she’d run an accountable and transparent White House.” But the Times editorial did not get to the heart of the matter. The larger question is, Why was she giving these speeches at all—and accepting such hefty payments for them—given Goldman Sachs’s record during the Great Recession of 2007–2008?

Set alongside such stricken competitors as Lehman Brothers and Bear Stearns, Goldman and its CEO Lloyd Blankfein are the great survivors of the crash: they actually came out ahead in their own derivatives trading during those years. Goldman and Blankfein’s admirers, including many in the financial media, have for the most part ignored the bank’s activities during the crash, despite multiple investigations and billion-dollar penalties against Goldman for its aggressive and deceptive marketing of financial derivatives. This has included a $5 billion settlement levied against the bank this January. How does this fit with Clinton’s self-portrayal as an opponent of the big banks and their excesses who is committed to their reform?

On the stump, Clinton’s criticisms of Wall Street can sound as radical as Bernie Sanders’s or Senator Elizabeth Warren’s. During a CNN debate with Bernie Sanders in March, Clinton said that she was in agreement that, “no bank is too big to fail, and no executive too powerful to jail” and that she has “the tools” to do it. In its earlier endorsement of Clinton in January, The New York Times itself highlighted her “proposals for financial reform” and her support for “controls on high-frequency trading and stronger curbs on bank speculation in derivatives,” which it cited as evidence that “she supports changes that the country badly needs.”

Yet Clinton’s repeated dealings with Goldman Sachs and its top executives since the financial crisis—including the 2013 speeches and more recent events involving the Clinton Foundation—run counter to such claims. To understand the significance of these dealings we have to bring together two strands of history. One concerns Bill and Hillary Clinton’s long-running connections to Goldman, among their closest with any US corporation. The second concerns Goldman’s activities leading up to and during the Wall Street crash of 2007–2008, including its deceptive marketing of contaminated mortgage derivatives.

The Clintons’ connections to Goldman Sachs can be traced back to their beginnings in national politics, in December 1991, when Robert Rubin, then co-chair co-senior partner of the bank, met Bill Clinton at a Manhattan dinner party and was so impressed by him that he signed on as an economic adviser to Clinton’s campaign for the 1992 Democratic nomination. According to a November 2015 survey of Clinton donors by The Washington Post, Rubin and other Goldman partners “mobilized their networks to raise money for the upstart candidate.”

As Bill Clinton’s secretary of the treasury from January 1995 until July 1999, Rubin was an architect of the financial deregulation that left financial derivatives such as Collateralized Debt Obligations (CDOs) largely free of controls. This paved the way for the large-scale, unregulated speculation in financial derivatives by Wall Street banks beginning in the early 2000s. (Goldman itself continued to enjoy special access to Washington during the George W. Bush administration, with former Goldman chief executive Hank Paulson serving as Treasury Secretary from 2006 to 2009.)

These long-running ties with Goldman have paid off for the Clintons. According to a July 2014 analysis in the Wall Street Journal, from 1992 to the present Goldman has been the Clintons’ number one Wall Street contributor, based on speaking fees, charitable donations, and campaign contributions, the three pillars of what I’ve called the Clinton System. As early as 2000, Goldman was the second most generous funder—after Citigroup—of Hillary Clinton’s 2000 Senate campaign, with a contribution of $711,000. In the early 2000s, Bill Clinton was also a Goldman beneficiary, receiving $650,000 from Goldman for four speeches delivered between December 2004 and June 2005. (The transcripts of these speeches do not appear to be currently available.)

By the winter of 2006–2007, however, Goldman and its CEO Lloyd Blankfein were becoming deeply involved in the collapsing housing bubble—and engaging in the practices that have since resulted in years of investigations and lawsuits. Data gathered mostly from the Corporate Research Project, a public interest website, show that on thirteen occasions between 2009 and 2016, Goldman was penalized by US courts or government agencies for fraudulent or deceptive practices that were committed mostly between 2006 and 2009. Four of these penalties amounted to $300 million or more.

In July 2010 the Securities and Exchange Commission fined Goldman $550 million for the fraudulent marketing of its Abacus CDO; the bank had allowed its client John Paulson to stuff the CDO with toxic ingredients, mostly in the form of mortgage-backed securities (MBSs), and then to bet against the CDO when it was marketed by taking a short position. Paulson earned around $1 billion when the CDO lost value as it was designed to do. In August 2011 the Federal Housing Finance Agency sued Goldman for “negligent misrepresentation, securities laws violations and common fraud” in its dealings with the semi-public mortgage banks Fannie Mae and Freddie Mac. In August 2014 Goldman agreed as restitution to buy back $3.15 billion worth of securities it had sold to the two banks for $1.2 billion more than they were currently worth.

In July 2012 Goldman agreed to pay $25.6 million to settle a suit brought by the Public Employees Retirement System of Mississippi accusing the bank of defrauding investors in a 2006 offering of MBSs. In January 2013, the Federal Reserve announced that Goldman would pay $330 million to settle allegations of foreclosure abuse by its mortgage loan servicing operations. Finally, in January of this year, Goldman announced that it would pay $5 billion to settle multiple lawsuits brought by official agencies against the bank, mainly for fraudulent marketing of CDOs; the final terms of the settlement were released on April 11. (Through the availability of tax credits and allowances, Goldman may end up paying less.) Among the plaintiffs were the Department of Justice, the New York and Illinois Attorneys General, the National Credit Union Administration, and the Federal Home Loan Banks of Chicago and Seattle.

These are summary descriptions of Goldman transgressions, which do no more than point to a pattern of deceptive and often fraudulent trading in derivatives. To get a more detailed sense of what exactly the bank was doing with these trades, we have to look at Goldman’s own record of its behavior during the crash. This record, which is now in the public domain, provides a stark backdrop to Clinton’s recent dealings with Goldman. The story begins on December 14, 2006 when David Viniar, Chief Financial Officer at Goldman and thus number four in the Goldman hierarchy, convened a meeting on the thirtieth floor of Goldman’s Manhattan headquarters. This was the seat of power where, along with Viniar, the bank’s Big Three had their offices: CEO Lloyd Blankfein, and co-vice presidents Gary Cohn and Jon Winkelried.

At the meeting Viniar called for an in-depth review of Goldman’s holdings of mortgage backed securities because its “position in subprime mortgage related assets was too long, and its risk exposure was too great.” The next day Viniar emailed a subordinate about the deteriorating housing markets, its effect on mortgage-backed securities, and not only the risks but also the opportunities this opened up. In his email Viniar alerted his subordinates to the possibility that the bank could profit from the deterioration of its own assets: “My basic message was let’s be aggressive distributing things because there will be very good opportunities as the markets [go] into what is likely to be even greater distress and we want to be in a position to take advantage of them.”

By February 11, 2007, Goldman CEO Lloyd Blankfein himself was urging Goldman’s mortgage department to get rid of deteriorating assets: “Could/should we have cleaned up these books before and are we doing enough right now to sell off cats and dogs in other books throughout the division”? But this was no easy task. In 2006 and 2007 Goldman created 120 complex financial derivatives, relying heavily on subprime mortgages grouped together in MBSs and CDOs with a total value of around $100 billion.

The problem was that the derivatives Goldman was busy creating were clogged with assets that were rapidly losing value. Faced with what it saw as a collapsing market, especially in MBSs, Goldman abandoned some derivatives that were still “under construction” while liquidating others that were fully formed, selling off their components in the markets. If this is all Goldman had done—anticipating where the market was going and unloading its bad assets—it would not have been the target of multiple lawsuits, and Blankfein might rightly be esteemed on Wall Street as the great survivor of the crash.

But Goldman also persisted with the creation of new CDOs and MBSs and continued marketing its existing ones so that they too could become part of new CDOs. Although the trading strategies involved in these maneuvers were sometimes highly complex, the motive underlying them was not. The bank’s executives believed that they could make more money by repackaging their collapsing assets into new CDOs and MBSs, which they could still market to clients as investment opportunities. Crucially, in doing this, Goldman was not simply acting as a “market maker,” an institutional trader that simply buys and sells securities at publicly posted prices. By marketing these new financial products, Goldman was also acting as underwriter and placement agent for them, and as such was subject to additional rules on fair disclosure.

On multiple occasions, as the Federal Housing Finance Agency’s 2011 lawsuit alleged, Goldman failed to disclose to its own clients how risky many of its derivatives were and that the bank itself was betting against them by taking the short position. At a hearing in April 2010 before the Senate Permanent Subcommittee on Investigations, Senator Carl Levin of Michigan confronted Blankfein about these practices:

Senator Levin: Is there not a conflict when you sell something to somebody and then are determined to bet against that same security and you don’t disclose that to the person you are selling it to? Do you see a problem?

Blankfein: In the context of market making, that is not a conflict. What clients are buying, or customers are buying, is they are buying an exposure. The thing that we are selling to them is supposed to give them the risk they want. …

Senator Levin: How about [if] you are investing in these securities. This isn’t a market making deal. This is where you have a decision to bet against, to take the short side of a security that you are selling, and you don’t think that there is any moral obligation here? …

Blankfein: Every transaction Senator, and that is—and I think it is important, and again, I am not trying to be resistant but to make sure your terminology—when as a market maker, we are buying from sellers and selling to buyers. …

Levin: You are betting against that same security you are out selling. I have just got to keep repeating this. I am not talking about generally in the market. I am saying you have got a short bet against that security. You don’t think the client would care?

Blankfein: I don’t—Senator, I can’t speak to what people would care. I would say that the obligations of a market maker are to make sure your clients are suitable and to make sure they understand it. But we are a part of a market process. We do hundreds of thousands, if not millions of transactions a day as a market maker.

As the force behind the 2010 Senate hearings and report, Senator Levin performed a great public service by bringing to light so much revealing information about the role of Goldman Sachs and other banks in the crash of 2007–2008. But at this critical moment in the hearing, Levin missed the crucial flaw in Blankfein’s defense: in marketing CDOs and MBSs to its clients, Goldman was not simply a market maker. It was an underwriter and placement agent that had manifestly violated rules of disclosure about the suitability of its products for its clients. This explains why Blankfein, in his exchanges with Levin, clung so desperately to the claims that he and Goldman were never more than humble market makers.

The Levin committee’s own investigation found extensive evidence that Goldman was more than a market maker in much of its trading activity during the crash. Consider the sales history of one Goldman product, its “Timberwolf” CDO, which it marketed between March and July 2007, a time when, as we have seen, Goldman’s executives had concluded that the US mortgage market was under growing distress. With a marketing value of $1 billion, the Timberwolf CDO gave investors the right to receive the income flows from interest payments on mortgages and other forms of debt held by the CDO, such as corporate, consumer, and student debt. (I discuss the history of Timberwolf in my 2014 book, Mindless: Why Smarter Machines Are Making Dumber Humans.)

As underwriter and placement agent for Timberwolf, Goldman produced a pitch book for clients that claimed that it was structured to “generate positive performance for the benefit of both debt and equity investors” and had “an objective of zero loss for CDO debt investments.” Yet Goldman emails subpoenaed by the Levin committee show that at the exact moment the bank was making this sales pitch, senior Goldman executives, including Blankfein, knew that the real market value of Timberwolf’s underlying assets was much lower, and that they were aiming to unload as much of the CDO as they could before it lost even more value.

On May 11, 2007, Daniel Sparks, then head of Goldman’s Mortgage Department, emailed a subordinate about Timberwolf: “I posted senior guys that I felt there is a real issue.…We are going to have a very large markdown [i.e. loss]…multiple hundreds.” (In trading jargon, the hundred here referred to is one dollar—one hundred cents—but a loss of “multiple hundreds” is still a big deal.) A week later the Mortgage Department’s analysts reported that “based on a small sample of single-A CDOs for which we have a complete underlier marks…the price of the A2 tranche of Timberwolf would actually be 35-41 cents on the dollar, depending on the correlation.”

By mid-June 2007, Sparks and Goldman’s Australian sales agent were trying to offload $100 million of Timberwolf assets as fast as they could to a local client, Basis Capital. The choice of an Australian client was significant. Goldman’s US clients were by then wary of Timberwolf; as of the second week of May the bank had made only one Timberwolf sale during the previous several weeks. This dearth of sales led Goldman to target what it called “nontraditional” clients “that can take larger bit size than traditional CDO buyers.” These included “Asian banks and insurance companies,” among them the Korean insurance company Hungkuk Life in Seoul, as well as Bank Hapoalim in Tel Aviv and Basis Capital in Sydney.

Unlike Goldman’s major US clients, these foreign clients may not yet have been aware of the rapid collapse of subprime markets in the US, and would be more receptive to the claims of Goldman’s Timberwolf pitch book. But there was no telling how long this ignorance would last, and Goldman’s global sales force was subject to a full-court press from Goldman’s top executives in New York City to move quickly; Blankfein was clearly aware of this. On June 13 Goldman’s salesman in Sydney received an anxious email from Sparks saying: “Let me know if you need help tonight…I’d love to tell the senior guys on 30”—the thirtieth floor at Goldman’s headquarters in New York City where Blankfein had his office—“at risk comm[ittee] Wednesday that you moved 100mm [$100 million].” Meanwhile, as the Timberwolf price collapsed, one party that had taken a 36 percent share of the bet against it was coming out well ahead: Goldman.

How have the Clintons responded to these revelations about Goldman Sachs, and their legal repercussions for the bank? Since we do not have the transcripts of Clinton’s 2013 speeches, it is impossible fully to answer this question. But we do know that Clinton received $675,000 from the bank for the speeches and all indications are that the Clinton-Goldman connections continued much as they had before the crash. Eyewitness accounts of Hillary Clinton’s 2013 Goldman speeches give some idea of their tone. One Goldman executive told Politico in early February that Clinton sounded “like a Goldman Sachs managing director,” while a report in The Wall Street Journal on February 11 quoted another unnamed source who said Clinton’s greetings toward her Goldman audiences “bordered on ‘gushy.’” These accounts are suggestive but no more than that.

A third indication of Hillary Clinton’s recent approach to Goldman executives, however, is more substantial. This is a speech Hillary Clinton gave to Goldman executives, including CEO Lloyd Blankfein, on September 23, 2014, that is available on YouTube. It took place during the annual meeting of the Clinton Global Initiative (CGI) in New York, of which Goldman has been a leading sponsor. In her comments, Clinton held up Goldman as an outstanding corporate citizen that was supporting a CGI initiative to promote the role of women in the global workforce: “It is really exciting for me to be here and to look around this room and see so many people who are committed to this mission that we share, certainly from the business world led by Goldman Sachs.”

Nor are these the only indications of the Clintons’ continued close ties to Goldman. After the $650,000 he received from Goldman in 2004–2005 Bill Clinton received another $600,000 from the bank between 2006 and 2014, including $200,000 in 2011 at a time when the bank was lobbying Hillary Clinton’s State Department for changes in the Budget Control Act. The final bill included the reauthorization of the Export-Import Bank, which helped finance a company in which Goldman was a part-owner. In 2011 the Clinton Foundation decided to leave its Harlem offices on West 125th Street in Manhattan, and moved downtown to a Goldman building on Water Street. Three years later, in May 2014, when the Clintons convened their leading donors to discuss the foundation’s future plans, they chose Goldman’s corporate headquarters in Lower Manhattan as the venue. In her current campaign for president, Hillary Clinton has hired Gary Gensler, a former Goldman banker and former chairman of the Commodity Futures Trading Commission, as her chief financial officer.

Finally, at the time of publication of this article, I have yet to discover any comment by Hillary Clinton on the $5 billion fine against Goldman Sachs announced in January, with the details finalized this week. In the words of Stuart F. Delery, the acting associate attorney general, “This resolution holds Goldman Sachs accountable for its serious misconduct in falsely assuring investors that securities it sold were backed by sound mortgages, when it knew that they were full of mortgages that were likely to fail.”

As the primary season reaches the crucial contests in the northeast and in California that will likely decide the ultimate victor, the dual history linking Goldman and the Clintons poses two questions that still need to be answered. First, should Lloyd Blankfein remain CEO of Goldman Sachs in view of the bank’s central involvement in the deceptive marketing of securities during the crash? Second, should he, and Goldman, remain the valued associates of Hillary Clinton, with both Clintons receiving inflated speaking fees from Goldman, and with Hillary Clinton performing what amounts to a high-end public relations effort for the bank, even as she styles herself as a reformer of the financial industry? As long as Clinton refuses to reveal the content of her Goldman speeches, the suspicion will remain that she has cast a blind eye on Goldman’s dark years and that her campaign pledge to “rein in Wall Street” cannot be taken seriously.

Original Article

Source: nybooks.com/

Author: Simon Head

No comments:

Post a Comment