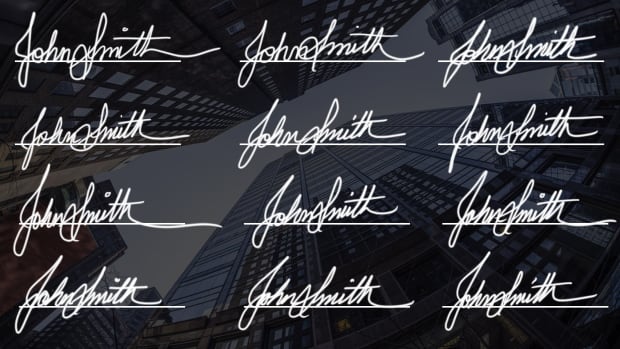

Employees in Canada's financial industry are speaking out about falsifying documents, telling Go Public that potentially criminal acts — like forging and photocopying customer signatures, adding initials to blank documents and using Wite-Out to conceal information — are more common than most people would think.

"It was easily 85 per cent of the back sales team doing it," says a former CIBC financial services representative, speaking about the last branch in which she worked, but adding that forging signatures on documents occurred in other branches she worked as well. CBC has agreed to conceal her identity.

The former employee, who left the bank last spring, says when she couldn't meet sales targets, her manager told her to forge customers' initials so it appeared that they had agreed to purchase insurance when they applied for a credit card, then cancel it a week or so later.

She also says a financial adviser who handled wealthy clients asked her almost two dozen times to forge customer signatures for insurance on loans, telling her his clients would never notice extra charges.

She says she finally quit because of stress and growing remorse.

"You feel pretty awful knowing that you could have caused some serious harm to them [customers] all in the name of profit for a bank."

CIBC declined an interview request, but a spokesperson said in a statement that "the kind of behaviour described would be unacceptable and result in immediate termination. We take any allegation of this nature seriously and investigate thoroughly."

A financial adviser who recently left TD Bank says he often witnessed his manager copying customers' signatures onto documents using "signature cards" on file.

He himself would scribble over the dates on people's credit checks, and then black out the scribbles with thick felt pen so no one could tell he pulled an Equifax report without a customer's knowledge — a practice he says his manager demonstrated on a blank piece of paper.

"They were showing you [how to do it], they were teaching you. But they would never say that they told you to do so," says the former TD employee.

TD Bank also declined an interview but said in a statement that it takes the allegations "very seriously" and such behaviour "would be a significant breach of our code of conduct" subject to disciplinary action, including dismissal.

Cases of signature falsification on rise

In its annual enforcement report released last week, the Mutual Fund Dealers Association of Canada (MFDA) says "signature falsification" was the primary allegation in 130 cases opened last year — more than double the number of cases in 2015, and almost three times the number it investigated in 2014.

Financial consultants usually forged signatures for the client or consultant's "convenience," the report says, and the number of forgery cases has increased due to improved detection by compliance departments within financial firms.

The problem of forging signatures was concerning enough for the MFDA to issue a bulletin in January — an update to similar bulletins issued in 2007 and expanded on in 2015.

It listed the deceptive methods people in the industry are using and warned against them, including copying a client's name on a document, cutting and pasting a signature, photocopying to "re-use" a signature, or using correction fluid to alter information on a document without a client's consent.

Although people in the financial industry have been found guilty of falsifying documents in recent years, few have served jail time or paid hefty fines.

"Forgery is supposed to be a criminal offence," says Stan Buell, of the Small Investor Protection Association. "But you could count on the fingers of one hand the people who have been charged criminally or sent to jail. It doesn't happen."

'It's not right to cheat old people'

Ten years ago, 97-year-old Harold Blanes says he asked his financial consultant to put about $400,000 of retirement savings into GICs — a safe investment, with no risk.

"We didn't want risk," the Kelowna man says. "We wanted our money saved, so we could enjoy it and help the kids with what they needed."

Blanes says his financial consultant ignored a box he had ticked and initialled, indicating he only wanted to invest his savings for a short term. Instead, documents show that the box next to it was marked with a squiggly line — supposedly someone's initials, says Blanes — allowing the consultant to invest his money for six years.

She ended up putting it into mutual funds that tanked when the market crashed in 2008.

"She said over and over it was all in guaranteed investments," says Blanes. "And we had nothing to worry about."

After years of fighting with those managing his money, Blanes's initial investment was returned. He is now taking his financial consultant to court, estimating he has lost $136,000 in compound interest.

"It's not right at all to cheat old people out of their money," says Blanes. "I think it's disgraceful."

His son, Alan Blanes, says he thinks regulators need to crack down on financial employees who fudge documents and forge signatures.

"Dad's had 10 years of his retirement ruined by having to obsess over this case."

'They're trying to keep the genie in the bottle'

Ottawa-based lawyer Harold Geller says he is contacted by "hundreds of people a year" who say those giving them financial advice have lied, cheated and, in many cases, falsified documents and forged signatures in order to line their own pockets or boost a bank or investment firm's revenues.

Geller blames the MFDA for not taking a more aggressive approach, taking issue with the association's claim that forgery is mostly done for "convenience."

"The Mutual Fund Dealers Association is a conflicted regulator," says Geller. "They are run by dealers and it's not in the dealer's interest to look into this issue. If there is not a complaint, [rarely] is this sort of thing looked for or caught."

Even when shady practices are caught, Geller says it can take about two years to reach a settlement; five years if the case goes to court. Either way, he says, investors are often muzzled by a confidentiality agreement.

"I think that they're trying to keep the genie in the bottle," he says. "If more people knew about the settlements that are available, there'd be more people looking for justice."

Calls for public inquiry

In a report released today calling attention to the issue of forgery, the Small Investor Protection Association says there is "absolutely no doubt" that the practice of document falsification is widespread.

"The truth is Canadians are losing billions of dollars of their savings every year due to systemic fraud and wrongdoing by the regulated investment industry," the report reads.

Buell says SIPA wants a government inquiry into investor protection.

"And they have to talk to the victims — not just the industry and regulators, and people who've done studies," he says. "Forgery is indicative of the behaviour of the investment industry."

Meanwhile, the former CIBC employee who routinely forged signatures says she's relieved to have left banking.

"But I actually feel fear for some of the new people entering the industry," she says. "Because there's a very big chance that they have no idea about what they are about to walk into."

Original Article

Source: CBC

Author: Erica Johnson

"It was easily 85 per cent of the back sales team doing it," says a former CIBC financial services representative, speaking about the last branch in which she worked, but adding that forging signatures on documents occurred in other branches she worked as well. CBC has agreed to conceal her identity.

The former employee, who left the bank last spring, says when she couldn't meet sales targets, her manager told her to forge customers' initials so it appeared that they had agreed to purchase insurance when they applied for a credit card, then cancel it a week or so later.

She also says a financial adviser who handled wealthy clients asked her almost two dozen times to forge customer signatures for insurance on loans, telling her his clients would never notice extra charges.

She says she finally quit because of stress and growing remorse.

"You feel pretty awful knowing that you could have caused some serious harm to them [customers] all in the name of profit for a bank."

CIBC declined an interview request, but a spokesperson said in a statement that "the kind of behaviour described would be unacceptable and result in immediate termination. We take any allegation of this nature seriously and investigate thoroughly."

A financial adviser who recently left TD Bank says he often witnessed his manager copying customers' signatures onto documents using "signature cards" on file.

He himself would scribble over the dates on people's credit checks, and then black out the scribbles with thick felt pen so no one could tell he pulled an Equifax report without a customer's knowledge — a practice he says his manager demonstrated on a blank piece of paper.

"They were showing you [how to do it], they were teaching you. But they would never say that they told you to do so," says the former TD employee.

TD Bank also declined an interview but said in a statement that it takes the allegations "very seriously" and such behaviour "would be a significant breach of our code of conduct" subject to disciplinary action, including dismissal.

Cases of signature falsification on rise

In its annual enforcement report released last week, the Mutual Fund Dealers Association of Canada (MFDA) says "signature falsification" was the primary allegation in 130 cases opened last year — more than double the number of cases in 2015, and almost three times the number it investigated in 2014.

Financial consultants usually forged signatures for the client or consultant's "convenience," the report says, and the number of forgery cases has increased due to improved detection by compliance departments within financial firms.

The problem of forging signatures was concerning enough for the MFDA to issue a bulletin in January — an update to similar bulletins issued in 2007 and expanded on in 2015.

It listed the deceptive methods people in the industry are using and warned against them, including copying a client's name on a document, cutting and pasting a signature, photocopying to "re-use" a signature, or using correction fluid to alter information on a document without a client's consent.

Although people in the financial industry have been found guilty of falsifying documents in recent years, few have served jail time or paid hefty fines.

"Forgery is supposed to be a criminal offence," says Stan Buell, of the Small Investor Protection Association. "But you could count on the fingers of one hand the people who have been charged criminally or sent to jail. It doesn't happen."

'It's not right to cheat old people'

Ten years ago, 97-year-old Harold Blanes says he asked his financial consultant to put about $400,000 of retirement savings into GICs — a safe investment, with no risk.

"We didn't want risk," the Kelowna man says. "We wanted our money saved, so we could enjoy it and help the kids with what they needed."

Blanes says his financial consultant ignored a box he had ticked and initialled, indicating he only wanted to invest his savings for a short term. Instead, documents show that the box next to it was marked with a squiggly line — supposedly someone's initials, says Blanes — allowing the consultant to invest his money for six years.

She ended up putting it into mutual funds that tanked when the market crashed in 2008.

"She said over and over it was all in guaranteed investments," says Blanes. "And we had nothing to worry about."

After years of fighting with those managing his money, Blanes's initial investment was returned. He is now taking his financial consultant to court, estimating he has lost $136,000 in compound interest.

"It's not right at all to cheat old people out of their money," says Blanes. "I think it's disgraceful."

His son, Alan Blanes, says he thinks regulators need to crack down on financial employees who fudge documents and forge signatures.

"Dad's had 10 years of his retirement ruined by having to obsess over this case."

'They're trying to keep the genie in the bottle'

Ottawa-based lawyer Harold Geller says he is contacted by "hundreds of people a year" who say those giving them financial advice have lied, cheated and, in many cases, falsified documents and forged signatures in order to line their own pockets or boost a bank or investment firm's revenues.

Geller blames the MFDA for not taking a more aggressive approach, taking issue with the association's claim that forgery is mostly done for "convenience."

"The Mutual Fund Dealers Association is a conflicted regulator," says Geller. "They are run by dealers and it's not in the dealer's interest to look into this issue. If there is not a complaint, [rarely] is this sort of thing looked for or caught."

Even when shady practices are caught, Geller says it can take about two years to reach a settlement; five years if the case goes to court. Either way, he says, investors are often muzzled by a confidentiality agreement.

"I think that they're trying to keep the genie in the bottle," he says. "If more people knew about the settlements that are available, there'd be more people looking for justice."

Calls for public inquiry

In a report released today calling attention to the issue of forgery, the Small Investor Protection Association says there is "absolutely no doubt" that the practice of document falsification is widespread.

"The truth is Canadians are losing billions of dollars of their savings every year due to systemic fraud and wrongdoing by the regulated investment industry," the report reads.

Buell says SIPA wants a government inquiry into investor protection.

"And they have to talk to the victims — not just the industry and regulators, and people who've done studies," he says. "Forgery is indicative of the behaviour of the investment industry."

Meanwhile, the former CIBC employee who routinely forged signatures says she's relieved to have left banking.

"But I actually feel fear for some of the new people entering the industry," she says. "Because there's a very big chance that they have no idea about what they are about to walk into."

Original Article

Source: CBC

Author: Erica Johnson

No comments:

Post a Comment